The Profit Margin: September 8, 2025

Statistic of the Week

In July, U.S. tariff revenues reached $27.7 billion, rising from $22.2 billion in May and $26.6 billion in June. Total government revenue for July was approximately $338 billion, with tariffs accounting for roughly 8.2% of that amount. According to Goldman Sachs research, U.S. companies have absorbed around 64% of the tariffs through July, while approximately 22% have been transferred to consumers.

Global Perspective

Global bond investors are driving yields upward amid growing worries over inflation and unsustainable debt burdens. In the United States, the 30-year Treasury yield climbed to nearly 5% while shorter-term yields declined. Meanwhile, Japan’s 30-year bond yield hit a record high with a yield of 3.29%. And, the UK’s 30-year gilt rose to 5.75%, marking its highest yield since 1998.

Market Moving Events

Wednesday: PPI

Thursday: Jobless Claims, CPI, Federal Budget

Friday: Consumer Sentiment

Commentary

Last week, domestic equity markets showed mixed performance. Although all three major U.S. equity indices reached record highs on Friday, a midday reversal caused the DJIA to close the week in negative territory, while the S&P 500 and Nasdaq managed to secure modest weekly gains.1 Specifically, the DJIA declined by 0.32%, the S&P 500 increased by 0.33%, and the Nasdaq snapped a two-week losing streak with a 1.14% rise.2 Meanwhile, short- and medium-term fixed income yields dropped significantly during the week, particularly following Friday’s nonfarm payroll report. The 10-year Treasury yield fell 0.16% compared to the previous week, closing at 4.08% on Friday—the lowest level since April.3

Economists and investors are toiling to determine if the struggling labor market is going to translate into a broader economic downturn. There is little debate that the labor market is deteriorating and that corporate uncertainty is the key contributing factor. The unemployment rate rose to 4.3%, wage growth is cooling, and while there do not appear to be mass layoffs, there does seem to be a broad-based hiring freeze. The Federal Reserve has a dual mandate: (1) maintaining maximum employment and (2) price stability. As a result of recent employment figures, investors now place a 67% probability of 0.75% in rate cuts in 2025, and the odds of a 0.50% rate cut at the September 17th meeting have increased.4 Complicating matters will be this week’s PPI and CPI inflation readings; both of which are expected to show inflation continuing to accelerate. Volatility could rise in the days ahead.

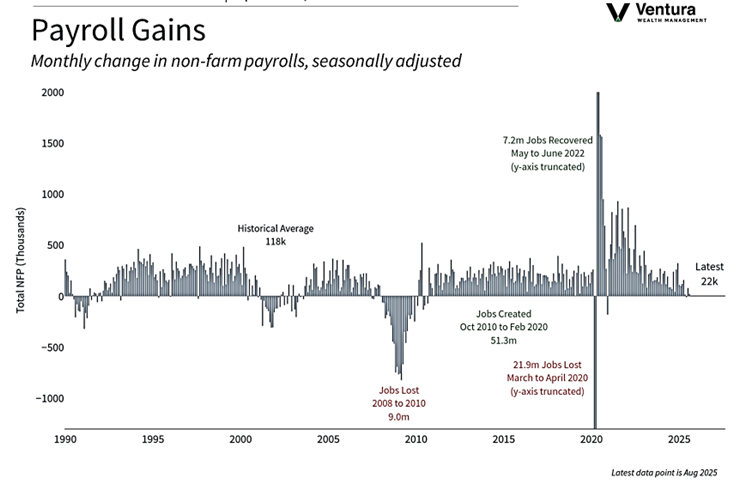

Chart of the Week

The labor market showed further signs of slowing in August. Non-farm payrolls rose by just 22,000 for the month, well below estimates of 75,000. The combined figure for June and July was revised lower by 21,000. The revised June payroll employment is now negative 13,000.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

Yahoo! Finance

Global Perspective:

The Wall Street Journal

Commentary:

1. Investor’s Business Daily

2. Bloomberg

3. MarketWatch.com

4. Barron’s