The Profit Margin: September 5, 2023

Statistic of the Week

Youth unemployment is a daunting problem for the Chinese economy. From 1978 to 2018, the Chinese economy doubled in size every ten-year period. It was in 1978 that Communist Party officials first adopted open-market reforms. For urban workers, age 16 to 24, the unemployment rate has been lingering around 20% for several months – double the pre-pandemic rate. This figure is raising questions about social mobility for the nation’s youth and has the potential to upset social stability.

Global Perspective

The French government is looking to spend €200 million to help farmers dispose of excess wine. The “crisis distillation aid programme” will convert the wine into ethanol for use in other products like perfumes. The Langudoc and Bordeaux regions are expected to be the most significant beneficiaries of the aid. Demand for wine has been falling, and French wine is facing increasing global competition.

Market Moving Events

Monday: US Markets Closed

Tuesday: Factory Orders

Wednesday: ISM Services, Beige Book

Thursday: Jobless Claims, Multiple Fed Governors Speaking

Friday: Consumer Credit

Commentary

Despite selling off early in the month, domestic equity markets rallied through month end and posted strong weekly performance. All three major averages finished the week in the black. The Nasdaq rallied hard, logging a gain of 3.25%.1 The S&P 500 moved 2.50% higher;2 and, the DJIA brought up the rear, climbing 1.43%.3 As we look ahead into the final third of 2023, market historians point out that when the S&P 500 has rallied between 10% and 20% through the end of August, it finished the year with an additional average gain of 7.6%.4

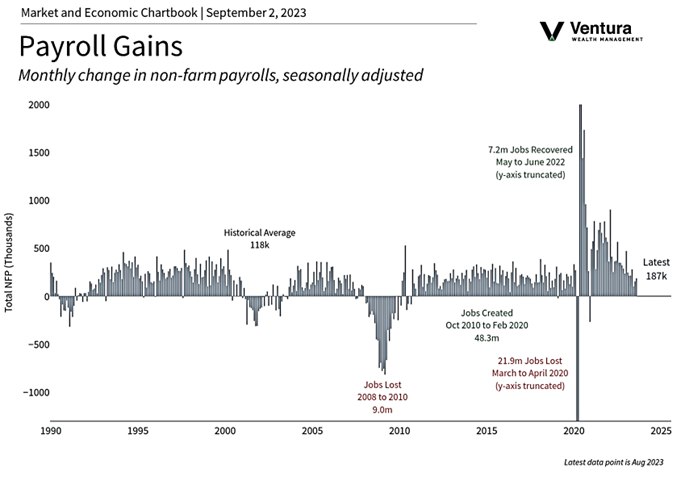

Most of last week’s optimism centered on the PCE inflation report and the Nonfarm Payrolls report. According to the PCE deflator (the Fed’s “favorite” inflation gauge), inflation continues to cool. Core rose 0.2% in August and the readings for the past three months annualize at an almost Goldilocks figure of 2.9%.5 The Nonfarm Payrolls report was a great report for the Federal Reserve. The economy added slightly more jobs than expected in the month (chart right) while the previous two months additions were revised down 110,000.6 The unemployment and labor force participation rates both ticked higher and wage growth slowed to 0.2%, an 18-month low.7 There is clearly some labor market softening which should help ease inflationary pressures. Is this enough for the Fed? On Thursday, five Fed Presidents will be giving public remarks – they will be sure to tell us… Their comments and Friday’s Consumer Credit report have the potential to move markets.

Chart of the Week

The U.S. economy added 187,000 jobs in August, slightly surpassing analyst expectations. The unemployment rate rose to 3.8%.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics, MarketWatch.com

Statistic of the Week:

The Economist

Global Perspective: The Financial TImes

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4. Barron’s, Bank of America

5. Investor’s Business Daily

6. Investor’s Business Daily

7. Investor’s Business Daily