The Profit Margin: September 25, 2023

Statistic of the Week

The majority of young people see social media influencing as a viable career path. A recent study found that 57% of GenZers believe they can become influencers, with 53% believing that it is a reputable career choice and approximately 3 in 10 willing to pay to become influencers. 41% of all adults would opt for this career path.

Global Perspective

With the conflict in Ukraine over 575 days old, Russia has banned fuel exports to the majority of countries. The move is designed to keep fuel prices within Russia lower and to keep the military well supplied. Russia has suffered from shortages of both gasoline and diesel in recent months. This action is likely to push global fuel prices higher.

Market Moving Events

Tuesday: New Homes Sales, Consumer Confidence

Wednesday: Durable Goods Orders

Thursday: Jobless Claims, GDP (revision)

Friday: Personal Income and Spending, PCE Index, Trade Balance, Consumer Sentiment

Commentary

Guidance by the FOMC and commentary by Federal Reserve Chair Powell further soured investor sentiment last week, pushing all three major domestic averages lower and yields higher. While the FOMC held rates steady, the committee indicated that they were still anticipating one more rate hike in 2023 and that they would be slower than previously indicated to cut rates in 2024.1 And while the commentary spooked both equity and bond investors, the futures market still places less than a 50% chance of another rate hike.2 This disconnect is being felt across asset classes.

The DJIA fared the best of the three averages, dipping 1.89%.3 The S&P 500 has now fallen for three consecutive weeks and six of the past eight weeks.4 It retreated 2.93%.5 And, the tech-heavy Nasdaq fell 3.62%.6 The pain was not only felt in the equity markets. The 2-year Treasury hit levels not seen since 2006 and the 10-year Treasury visited yields not seen since 2007.7 Remember, high bond yields mean lower bond prices.

The week ahead will not be for the faint of heart. News surrounding the potential government shutdown will play front and center. Social Security checks will still be distributed.8 But, the shutdown will impact many federal employees and contractors and could delay the implantation of the next cost of living adjustment.9 The Fed’s favorite inflation gauge, the PCE will be released along with key housing data.

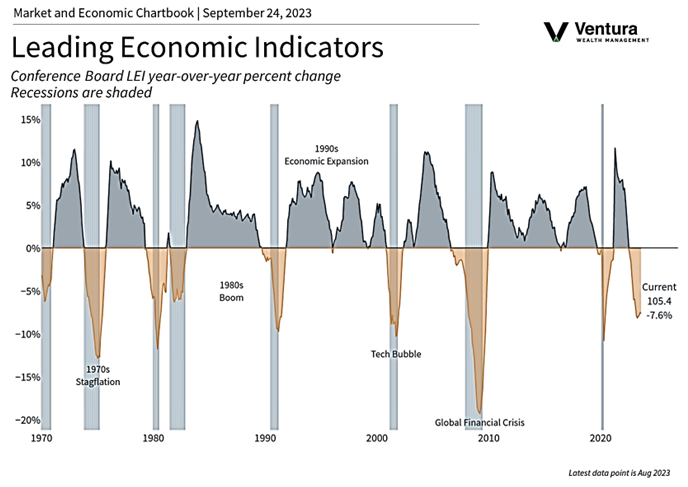

Chart of the Week

The Conference Board’s Index of Leading Economic Indicators fell for the 17th consecutive month. The decline of 0.4% in August was less than analyst estimates of 0.5%. Six of the ten components dropped during the month.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, The Conference Board, MarketWatch.com

Statistic of the Week:

CNBC.com

Global Perspective:

Reuter’s

Commentary:

1.Bloomberg

2. Investor’s Business Daily

3.Bloomberg

4. Bloomberg, Investor’s Business Daily

5.Bloomberg

6.Bloomberg

7.Bloomberg

8. Barron’s

9. Barron’s