The Profit Margin: September 22, 2025

Statistic of the Week

Social Security benefits are not taxed in forty-one states plus Washington D.C. However, nine states—Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont, and West Virginia—impose taxes on some or all Social Security income. Among these, only Minnesota and Utah apply taxation using the same income criteria as those established at the federal level.

Global Perspective

TikTok, the widely used social media platform, has been a major point of discussion between the U.S. and China. Owned by ByteDance, a Chinese company, TikTok’s American assets are set to be transferred to U.S. owners following an agreement announced by President Trump. The deadline for ByteDance to divest its U.S. assets has been extended to allow more time for finalizing the deal’s terms.

Market Moving Events

Tuesday: S&P Flash Services PMI, S&P Flash Manufacturing PMI

Wednesday: New Home Sales

Thursday: Jobless Claims, GDP Revision, Durable Goods Orders, Existing Home Sales

Friday: Personal Income and Spending, PCE Index, Consumer Sentiment

Commentary

The Federal Reserve met market expectations by cutting interest rates one quarter of a point, making for a relatively smooth week of trading. All three major domestic equity indices rose on the week, and each hit a record high over the course of trading. The Nasdaq was once again the leading performer, rallying 2.21%.1 The S&P 500 jumped 1.22%.2 And, the DJIA increased 1.05%.3 Bond yields initially fell after the Fed’s announcement, but they ultimately finished the week higher. At one point, the 10-year Treasury yield dipped below 4%, only to finish the week .06% higher at 4.13%.4

The week ahead is full of commentary by FOMC officials. With earnings’ season behind us, commentary from the governors will garner ample attention. The only day without a speech is Wednesday. Chair Powell is slated to give public remarks on Tuesday. Newly appointed, and somewhat controversial, Governor Miran, will give a speech on Monday that will be closely followed. In Chair Powell’s news conference last week, he noted that the board is fairly split regarding the magnitude of future 2025 rate cuts.5 Some governors believe one more cut will be sufficient, while others believe two to be preferable. Two cuts looks probable.

Helping determine that course of action will be the release of the PCE inflation index due this Friday. Analysts believe that both the headline and core readings will show that inflation accelerated in the month of August, with the core reading moving up to the psychologically significant reading of 3.0%.6 Higher inflation readings will make the path of future rate cuts less certain. Remember the adage, “Don’t fight the Fed.”

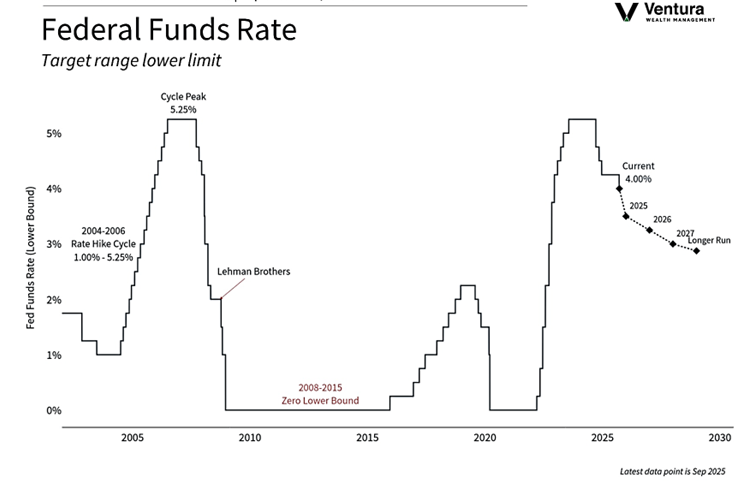

Chart of the Week

With Wednesday’s announcement of a rate reduction, the Federal Open Market Committee (FOMC) set the new lower boundary of its target range at 4.00%. The FOMC anticipates implementing two more 0.25% rate cuts before the year concludes.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

The Federal Reserve

Statistic of the Week:

Investopedia

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. MarketWatch.com

5. Investor’s Business Daily

6. Investor’s Business Daily