The Profit Margin: September 2, 2025

Statistic of the Week

September has traditionally been the weakest month for major U.S. stock indices. Since 1897, the DJIA has recorded gains in September only 42.2% of the time, with an average monthly decline of 1.1%. Similarly, albeit over shorter timeframes, the S&P 500 and Nasdaq have shown comparable trends. The S&P 500 has posted positive returns in just 44.9% of Septembers since 1928, while the Nasdaq has seen gains in only 51.9% of Septembers since 1971.

Global Perspective

Argentina’s central bank raised reserve requirements for banks for the third time in recent weeks as part of measures to support the peso. The current government is also dealing with significant corruption accusations which have undermined investor confidence in the country’s business environment, equity markets, and currency.

Market Moving Events

Tuesday: ISM Manufacturing, Construction Spending

Wednesday: JOLTS, Factory Orders, Beige Book, Auto Sales

Thursday: Jobless Claims, ISM Services, Trade Deficit

Friday: Nonfarm Payrolls

Commentary

Despite a plethora of significant headlines last week, market action remained relatively subdued. All three major domestic equity indices experienced slight declines. The S&P 500 edged down 0.10%, while both the Nasdaq and the DJIA dropped 0.19%.1 Notably, the S&P 500 and Nasdaq continue to hover near all-time highs. Meanwhile, the 10-year Treasury yield decreased by 0.04%, finishing Friday at 4.23%.2

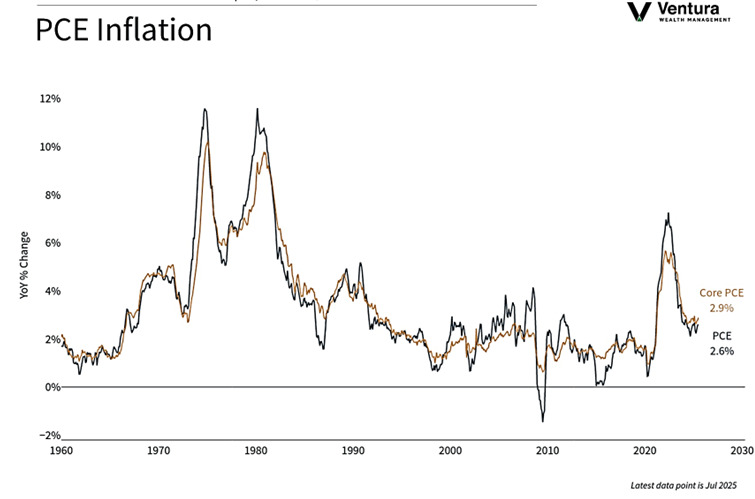

A complicated relationship between the Fed, inflation, tariffs, and fixed income yields remains the dominant narrative in the investment markets. Last week’s PCE inflation reading, chart right, indicated that inflation continued to accelerate in the month of July. Economists largely attribute this acceleration to the Trump administration’s tariff policies. Importantly, after the bell on Friday, a lower-level court ruled that many of the administration’s tariffs were illegal. The tariffs will remain in place until this case is heard by the Supreme Court. Legal analysts note that even if the Supreme Court strikes down the tariffs, the administration has other avenues to pursue tariff policy. Also in the courts was Federal Reserve Governor Lisa Cook. Cook was fired by President Trump for allegedly falsifying mortgage records. She is suing the administration in an attempt to retain her job. There was no immediate decision from her hearing. Importantly, Federal Reserve Jay Powell has asked that Cook stay at her post until the court decides on the fate of her job. While shorter-term yields have been relatively stable, arguably in anticipation of an interest rate cut at the September FOMC meeting, the 30-year Treasury yield hit 4.96% last week. Bond investors are starting to show signs of jitters.

Chart of the Week

The PCE Inflation index for July was in-line with analyst expectations. Headline year-over-year inflation registered at 2.6%, while the core inflation rate increased to 2.9%.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

MarketWatch.com

Global Perspective:

The Wall Street Journal

Commentary:

1. Bloomberg

2. MarketWatch.com