The Profit Margin: September 19, 2022

Statistic of the Week

States in the sunbelt have been the welcome recipients of high-income earners relocating to more tax-friendly locales. A recent study found that over 20,000 households earning more than $200,000 have moved to Florida since 2019. Texas came in second at north of 5,300 households. The top five slots were rounded out by Arizona, North Carolina, and South Carolina.

Global Perspective

China’s three-day Mid-Autumn Festival was a financial bust this year. Tourism revenues from the festival activities generated about 28.68 billion yuan (approximately $4.16 billion). This figure represents revenues of about 60.6% of 2019 levels and a decline from 2021 levels of 22.8% according the Ministry of Culture and Tourism. Tighter COVID controls are largely being blamed.

Market Moving Events

Monday: NAHB Home Builder’s Index

Tuesday: Building Permits, Housing Starts

Wednesday: Federal Reserve Statement, Federal Reserve Chair Press Conference, Existing Home Sales

Thursday: Jobless Claims, Leading Economic Indicators

Commentary

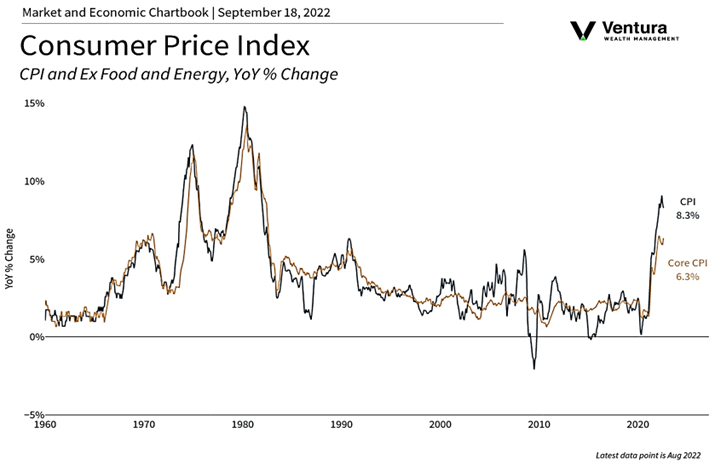

Inflation data once again soured investor sentiment and pushed the major equity indices lower on the week. An earnings miss and vocal concerns about a global slowdown from the FedEx CEO did not help matters. All three major averages finished the week lower. The DJIA held up the best, retreating 4.13%.1 The S&P 500 fell 4.77%.2 And yet again this year, the tech-heavy Nasdaq faired the worst, dipping 5.48%.3 Investors did not find solace in the fixed income markets as yields rose. The 10-year Treasury finished Friday with a yield of 3.45%, up 0.13% from the week prior.4

Despite the reactions in the markets, the inflation data was not that bad. Core CPI (which does not usually make the 6 o’clock news) was the real news item, coming in up 0.6% for August while analysts expected a gain of 0.3%.5 The PPI figures on Wednesday were more-or-less in line with expectations. With a selloff of about 5% in equities last week, the stage is set for a critical Federal Reserve announcement on Wednesday. Investors are expecting a 0.75% rate hike. (There had been some calls for a 1.00% increase after last week’s inflation data, however, the futures markets are indicating a strong probability for 0.75%).6 The headlines will likely be made in the press conference following the announcement. Fed Chair Powell will have everyone’s attention – a misstep could add to an already volatile market while an agile performance could soothe concerns about over-aggressive action.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Haver,

Bureau of Labor Statistics

Statistic of the Week:

CNBC.com

Global Perspective:

CNBC International

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Barron’s

6. Barron’s