The Profit Margin: September 18, 2023

Statistic of the Week

Most workers believe that saving $1 million is no longer enough to retire comfortably. In a survey released in August of this year, the average American worker now believes that they will need $1.8 million to retire. Part of the trouble – only 37% of respondents believe that they will be able to reach this level. If you are unsure if you are saving enough to retire comfortably, please speak with your VWM wealth advisor.

Global Perspective

The United Auto Workers continued their strike of the big three auto manufacturers into the weekend. There are 143,744 workers on strike against Ford, GM, and Stellantis. Should the strike go on for 10 days, manufacturers are expected to lose $989 million, workers are expected to lose $859 million, and the total impact to the U.S. economy is expected to be approximately $5.6 billion.

Market Moving Events

Tuesday: Housing Starts

Wednesday: FOMC Interest Rate Decision, Chair Powell Press Conference

Thursday: Jobless Claims, Leading Economic Indicators

Commentary

Despite a lousy trading session Friday, the major U.S. equity markets finished the week close to flat. The DJIA was the week’s leader, up 0.12%.1 The S&P 500 sank 0.16% while the Nasdaq fell 0.39%.2 The S&P 500 has now finished in the red in five of the past seven weeks;3 it should not be forgotten that the index is up well into the double digits for a year-to-date return. Fixed income yields rose as investors weighed inflation data. The 10-year Treasury finished Friday with a yield of 4.33%, up 0.06% from the week prior.4

The week ahead will likely center on the FOMC rate decision Wednesday, Chair Powell’s subsequent press conference, and public statements from several Fed officials Friday. The market is expecting no change in interest rate policy at this meeting, and the futures market reflects a 73% chance of “no change” at the next meeting announcement in November.5 Most attention will focus on medium term projections in the Fed’s guidance. At the June meeting, 12 of 18 officials indicated they believed one more hikes would be necessary in 2023.6 Six officials opposed hikes.7 Will there be any change along these lines? The FOMC’s guidance shows projections for a full 1.00% reduction in rates between now and the end of 2024.8 There is a lot of space between those two outcomes. With inflation easing and a defiantly strong consumer and labor market, the Fed may just have a “goldilocks” scenario on their hands. It’s too soon to tell.

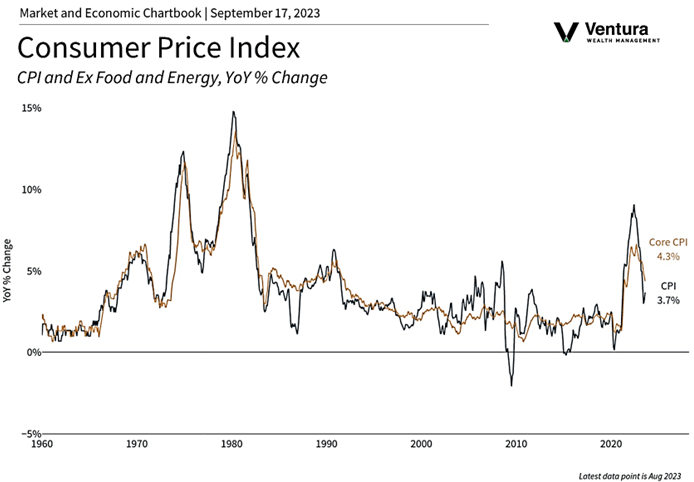

Chart of the Week

The inflation rate ticked up in August, driven by gasoline prices. The CPI rate and Core CPI rate were more-or-less in line with analyst estimates, if a little hot. The CPI and PPI readings are hinting at a softening PCE figure. The PCE price index is the Fed’s primary inflation gauge.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics, Investor’s Business Daily

Statistic of the Week:

CNBC.com, Charles Schwab

Global Perspective: Yahoo! Finance

Commentary:

1.Bloomberg

2.Bloomberg

3. Investor’s Business Daily

4.Bloomberg

5. Investor’s Business Daily

6. Investor’s Business Daily

7. Investor’s Business Daily

8. Barron’s