The Profit Margin: September 16, 2024

Statistic of the Week

Last week, mortgage rates hit the lowest levels they have seen since February 2023. The average interest rate for a 30-year mortgage moved down from 6.43% to 6.29%. Applications for a mortgage to purchase a home also ticked up 2% for the week. Notably, there were about 3% fewer applications last week than in the same week one year ago.

Global Perspective

Former President of the European Central Bank and prime minister of Italy, Mario Draghi, released a much-anticipated report on European growth and competitiveness. In his findings, he encourages EU countries to combine research spending and ease rules on competition to allow for sizable mergers. Draghi also urges that European capital markers go through a period of consolidation.

Market Moving Events

Tuesday: Retail Sales, Industrial Production, Homebuilder Confidence

Wednesday: FOMC Rate Decision, Housing Starts, Fed Chair Press Conference

Thursday: Jobless Claims, Existing Home Sales, Leading Indicators

Commentary

A broad and strong rally in the equity markets undid most of the damage from the week prior, erasing most of the month-to-date losses for the major averages. All three major averages posted solid gains. The DJIA was the laggard on the week; the index rose 2.60%.1 The S&P 500 rallied 4.02%.2 And the Nasdaq, which declined sharply in the week prior, jumped 5.95%.3 Fixed income yields fell as markets prepare for the September FOMC rate announcement this Wednesday. The yield on the 10-year Treasury declined 0.06% to finish Friday at 3.66%.4

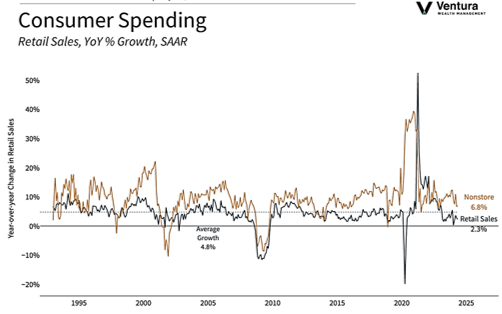

The “big” news last week was that inflation, as measured by the CPI (chart right) and PPI, seem to be stabilizing in a zone that is acceptable to the Federal Reserve. Currently, the odds of a 0.25% rate cut or a 0.50% rate cut are nearly 50/50.5 Importantly, markets are placing a 92% probability that there will be a total 1.00% cut between now and the end of the year.6 As the Fed tries to maneuver rate cuts around the politics of a presidential election, they face an interesting conundrum. If they cut 0.25% this week and the labor market deteriorates rapidly, they may be forced to cut 0.75% in December. A 0.75% cut would likely sound alarm bells. However, if they cut 0.50% this week, and inflation starts to pick up and the labor market improves, they could be accused of an overreaction or trying to boost the economy right before the election. Unfortunately for the Fed, with just over 50 days until the election, any action they take will be painted with politics. Beyond the FOMC announcement, retail sales figures and several key housing indicators will be released this week. Both will shed light on the mindset of the consumer.

Chart of the Week

The CPI report for August showed inflation continuing to cool in the U.S. economy. (The slowing of the inflation rate is called “disinflation”). The 0.2% increase in August contributed to a 2.5% year-over-year change. This reading was the smallest annual increase since February 2021.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

CNBC.com

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. MarketWatch.com

5. Investor’s Business Daily

6. Investor’s Business Daily