The Profit Margin: September 15, 2025

Statistic of the Week

A growing portion of individuals aged 65 and older remain in the workforce. Around 20% of this age group continue working during their typical retirement years, driven by either personal choice or financial need. Between 2013 and 2023, the population segment over 65 increased by nearly 33%.

Global Perspective

In August, Chinese exports increased by 4.4% year-over-year, marking the slowest export growth rate since February of this year. Exports to the United States declined sharply by 33%, while shipments to Southeast Asia rose by 22.5%, and exports to the European Union grew by 10%.

Market Moving Events

Tuesday: Retail Sales, Import Prices, Industrial Production

Wednesday: Housing Starts, Business Permits, FOMC Meeting Announcement, FOMC Chair Press Conference

Thursday: Jobless Claims, Leading Economic Indicators

Commentary

Domestic equity markets maintained their upward momentum last week, with all three major indices reaching fresh record highs.1 The Nasdaq led the gains, advancing 2.03%, followed by the S&P 500, which increased by 1.59%.2 Bringing up the rear, the Dow Jones Industrial Average rose 0.95%.3 Fixed income yields remained largely steady, with the 10-year Treasury yield declining slightly by 0.01%, closing Friday at 4.07%.4

Last week, investors were presented with two disappointing labor market reports. First, the Bureau of Labor Statistics revealed that the U.S. economy added 911,000 fewer jobs over the twelve months ending March 31, 2025.5 Then, on Thursday, the initial jobless claims report showed 263,000 people filing for unemployment,6 surpassing the significant 250,000 threshold. Notably, several economists attribute the unusually high number primarily to seasonal adjustment factors.

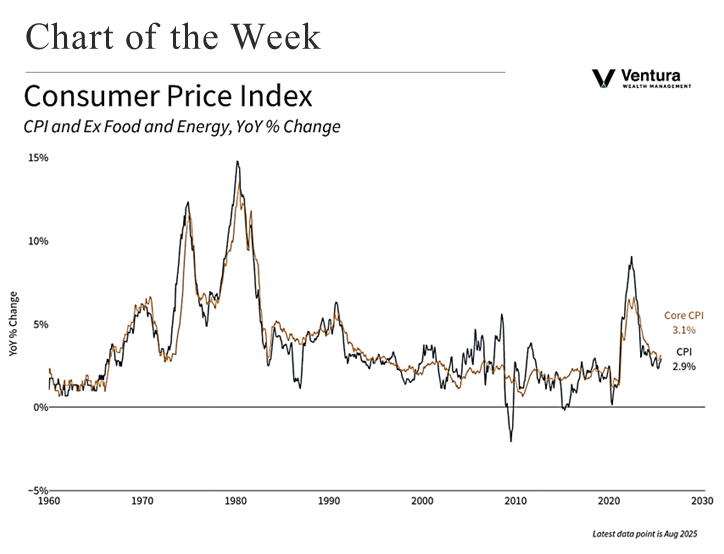

Last week, both the PPI and CPI inflation reports were released. On a positive note, the PPI came in below expectations, declining by 0.1% for the month and notching a year-over-year rate of 2.6%.7 Meanwhile, the CPI figures (see chart) was in line with analyst forecasts.

This coming week, the focus will be on the FOMC meeting announcement scheduled for Wednesday. Markets currently reflect a 100% probability of a rate cut, with a 95% likelihood of a 0.25% reduction and a 5% chance of a 0.50% decrease.8 The Fed will also release its rate projections for 2026. So far, market expectations suggest a significantly more aggressive pace of rate cuts compared to the FOMC’s outlook at its June meeting.

Chart of the Week

In August, the CPI increased 0.4% making the year-over-year increase 2.9%. This 0.4% monthly rise represents the highest monthly gain since January. The core reading, which excludes food and energy, increased by 0.3% in August and 3.1% year-over-year.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

Investor’s Business Daily

Global Perspective:

The Wall Street Journal

Commentary:

1. Investor’s Business Daily

2. Bloomberg

3. Bloomberg

4. MarketWatch.com

5. Barron’s

6. MarketWatch.com

7. MarketWatch.com

8. Barron’s