The Profit Margin: September 12, 2022

Statistic of the Week

The nation’s largest financial institutions have set aside approximately $4.8 billion less for bonuses in 2022 than they had in 2021 according to a recent report by Johnson Associates. Projections show that employees who underwrite debt and equity could see their bonuses fall by 45%, while those that advise on mergers and acquisitions activity would see their bonuses fall by approximately 25%.

Global Perspective

India has now surpassed the United Kingdom to become the world’s sixth largest economy. The former colony moved passed the UK in the last quarter of 2021. While it looks likely that Great Britain will slip into a recession in the second half of 2022, the Indian economy is forecast to grow by 7% this year.

Market Moving Events

Tuesday: Consumer Price Index, Federal Budget

Wednesday: Producer Price Index

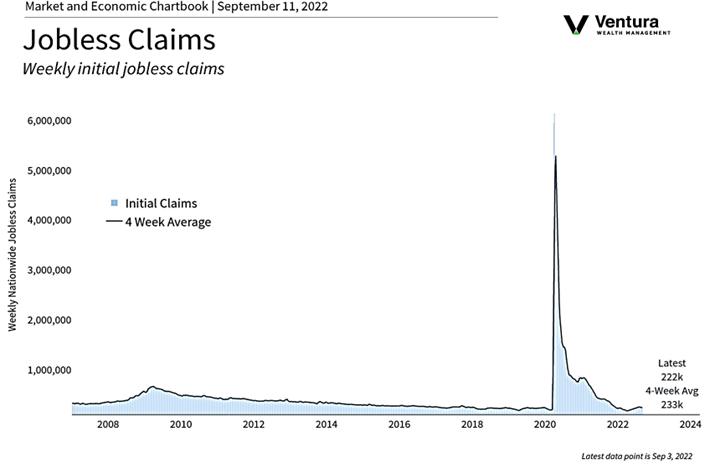

Thursday: Jobless Claims, Retail Sales, Empire State Manufacturing, Industrial Production, Business Inventories

Friday: Consumer Sentiment

Commentary

Domestic equity markets snapped a multi-week losing streak as all three major averages put in sizable moves higher. The Nasdaq was the leader, rallying 4.04%.1 The S&P 500 climbed 3.65%.2 And the DJIA brought up the rear, jumping 2.66%.3 There was little debate that we began last week in “oversold” territory, and that a glimmer of good news could push the markets higher. Several Federal Reserve governors gave public comments last week which were in line with expectations. Also, the economic data on the week was positive overall, helping push back the “are we or aren’t we in a recession” conversation. As equities rallied, interest rates rose. The 10-year Treasury finished Friday with a yield of 3.32%, up 0.13% from the week prior.4

Unsurprisingly, inflation will remain a key focus item in the week ahead as both the consumer price index and producer price index August reports will be released. With many Federal Reserve governors indicating that policy rates will be “higher for longer” (read: restrictive policy for a longer period of time), improvement in the inflation situation will likely be welcomed by investors. Friday’s consumer sentiment figure will also be watched – a recent survey found that 52% of Americans believe the economy will be in worse shape six months from now.5 As the economy and investor sentiment continue to waver, substantial and/or surprise shifts in this week’s economic indicators may have a disproportionate impact on the investment markets.

Chart of the Week

Sources

Statistic of the Week:

Bloomberg Opinion

Global Perspective:

Bloomberg Business

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Haver,

Bureau of Labor Statistics

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Investor’s Business Daily