The Profit Margin: September 11, 2023

Statistic of the Week

Do you know what investments are available in your company-sponsored retirement plan? A recent survey that asked 1,676 individuals found that 46% of respondents did not know what investments were available to them in their workplace plan (like a 401(k), 403(b) or TSP). This is an alarming statistic as approximately 59% of employers use automatic enrollment in these retirement savings vehicles. If you have questions about the options in your employer plan, please contact your VWM Wealth Advisor.

Global Perspective

More than 2,000 have perished in a 6.8 magnitude earthquake that struck Morocco on Saturday. It was the deadliest earthquake in Morocco in decades. Much of the damage struck villages in the foothills of the High Atlas mountain range. The nation has Africa’s fifth largest GDP, estimated to be $139 billion with a population of approximately 37 million people.

Market Moving Events

Wednesday: Consumer Price Index

Thursday: Jobless Claims, Producer Price Index, Retail Sales

Friday: Industrial Production, Import Prices, Consumer Prices

Commentary

Coming off a long-weekend, investors were less than enthusiastic in last week’s trading. All three major indices finished the week in the red. The Nasdaq, the year-to-date leader by a significant margin, fared the worst, dropping 1.93%.1 The S&P 500 fell 1.29%.2 And the DJIA logged a two-week losing streak, retreating 0.75%.3 Yields were up on the week as odds of a “soft landing” for the U.S. economy continue to increase. The 10-year Treasury finished Friday with a yield of 4.27%.4

With the next FOMC meeting scheduled for September 19-20 and no rate hike expected, investors are weighing whether “good news” regarding the economy’s prospects should be treated as “good news” in the investment markets. S&P Global released a note saying that they expect second quarter economic growth for the U.S. economy to be revised higher and third quarter growth to come in around 4.00%.5 The last major inflation data points before the FOMC’s meeting, CPI (Wednesday) and PPI (Thursday) may influence commentary from the Fed. Higher energy prices are expected to push the CPI higher, while lower goods prices will likely pull-down Core CPI (which excludes food and energy).6 Initial jobless claims hit a 7-month low (this could be partly due to trouble reporting because of Hurricane Idalia).7 And there has been recent debate as to whether the U.S. consumer has more “excess savings” than the Federal Reserve Bank of San Francisco believes.8 This is not a terrible backdrop. How will investors respond?

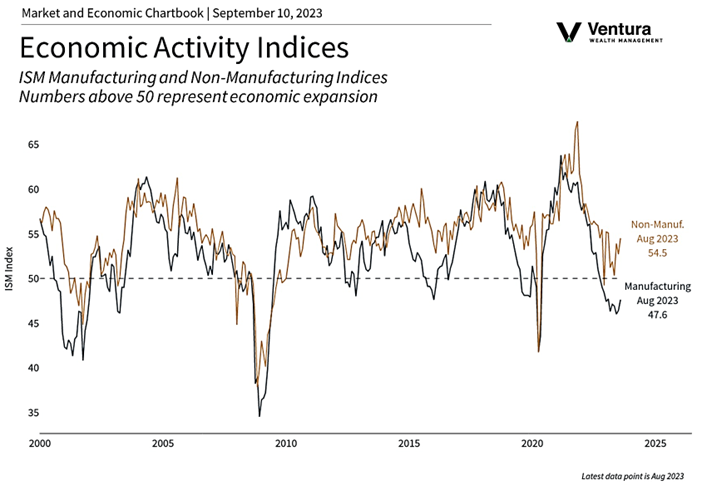

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Institute for Supply Management, MarketWatch.com

Statistic of the Week:

CNBC.com

Global Perspective: CNN.com, International Monetary Fund

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Investor’s Business Daily

6. Investor’s Business Daily

7. Investor’s Business Daily

8. Barron’s