The Profit Margin: October 9, 2023

Statistic of the Week

For the week ended September 29th, the 30-year mortgage rate rose to 7.53%, up from about 6.6% a year ago. This rate is the highest home buyers have seen since 2007. Home purchase applications have fallen to their lowest levels since 1995. Higher home prices plus higher interest rates have combined to dramatically cool the real estate market.

Global Perspective

It is estimated that in Mexico, gangs and criminal organizations combine to create the nation’s fifth largest employer. As administration after administration failed to control the problem, a new study suggests that the best way to stop the gangs may be to attempt to prevent recruitment of new members. Doing so could theoretically cut gang figures to half of the 2027 projected membership: an astonishing 225,000 individuals.

Market Moving Events

Wednesday: PPI, FOMC Meeting Minutes

Thursday: Jobless Claims, CPI

Friday: Import Prices, Consumer Sentiment

Commentary

Investors looking for a silver lining in the September nonfarm payrolls report pushed equity markets higher for the week. While the DJIA retreated -0.30%,1 the more diversified S&P 500 rose 0.48%,2 and the tech heavy Nasdaq moved up 1.60%.3 As the longer end of the yield curve continues to “normalize” (when long-term yields move to be higher than short-term yields), both bond and equity prices have been under pressure. The 10-year Treasury yield rose nearly 0.25% on the week (a substantial move) to finish Friday with a yield of 4.80%.4 During the week, the yield was as high as 4.89%.5 Concerns about inflation, Fed policy, and the ongoing disruptions in the House of Representatives (ultimately tied to Federal spending and debt levels) are fueling the volatility.

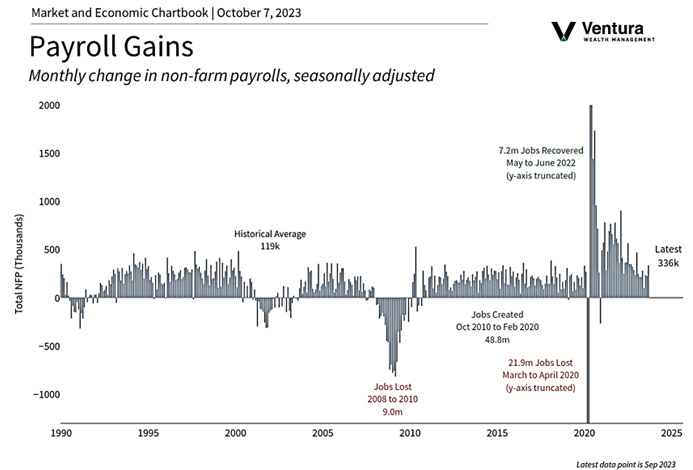

Friday’s nonfarm payroll figure saw the U.S. economy add 336,000 jobs in September, well above estimates of 170,000.6 The labor force participation rate stayed the same, as did the unemployment rate. The silver lining? Wage growth. Wage growth for the month was 0.2%.7 A string of wage growth figures shows this metric softening which is likely to help further cool inflation. On the inflation front, this week we will receive both the Producer Price Index and Consumer Price Index readings. Earnings season will start as several major financial firms will report. The conflict in Israel and Gaza has heightened investor concerns and has caused an uptick in oil prices.

Chart of the Week

The domestic economy added 336,000 jobs in the month of September, far surpassing analyst estimates. The unemployment rate remained unchanged at 3.8%.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics

Statistic of the Week:

Businesweek,

USA Today

Global Perspective: The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Marketwatch.com

5. Investor’s Business Daily

6. Investor’s Business Daily

7. Investor’s Business Daily