The Profit Margin: October 31, 2022

Statistic of the Week

According to the National Retail Foundation, spending for Halloween 2022 hit a record high, totaling approximately $10.6 billion. This represents a $500 million increase from the spend in 2021. The figure is $8 billion greater than what was spent during 2020. The jump in spending from 2020 to 2021 is the largest on record. Notably, candy prices are up 13% year over year.

Global Perspective

The yields on British government bonds have eased back to where they were prior to the proposed unfunded tax cuts by the Truss administration. The disastrous tax cut proposal has largely been abandoned. The yield on 30-year gilts traded down to 3.7% on the day following the appointment of the new prime minister, Rishi Sunak.

Market Moving Events

Tuesday: ISM Manufacturing Index, Construction Spending, Vehicle Sales

Wednesday: FOMC Meeting Announcement, Fed Chair Press Conference

Thursday: Jobless Claims, ISM Services, Factory Orders

Friday: Nonfarm Payrolls

Commentary

As investors focused on third quarter earnings reports, domestic equity markets put in strong gains last week. The DJIA led the pack, rallying 5.72%.1 The S&P 500 rose 3.95.2 And the Nasdaq brought up the rear, climbing 2.24%.3 While there were some notable earnings misses on the week, we are currently seeing about 70% of companies exceeding expectations so far in the reporting cycle.4 (Just under half of S&P 500 companies had reported through Friday).5 While equities rose, yields on fixed income fell. The yield on the 10-year Treasury dipped 0.20% to finish the week at 4.01%.6

The big question this week is whether investors will continue to focus on earnings reports or shift their attention to Federal Reserve policy. Last week we received the Fed’s favorite inflation indicator, the core PCE deflator. The reading came in more-or-less in line with expectations at an annualized rate of 5.1%.7 The Fed will hold a two-day meeting on Tuesday and Wednesday with a rate announcement and press conference on Wednesday. We do not believe that the PCE reading changed the trajectory of the Fed’s policy moves. Futures markets are showing a greater than 80% chance that the central bank will increase rates by 0.75%, bringing the target rate to 3.75%-4.00%.8 Markets are also showing a strong likelihood of a 0.50% rate hike in December.9 Friday’s nonfarm payrolls report could impact the projected magnitude of the December hike.

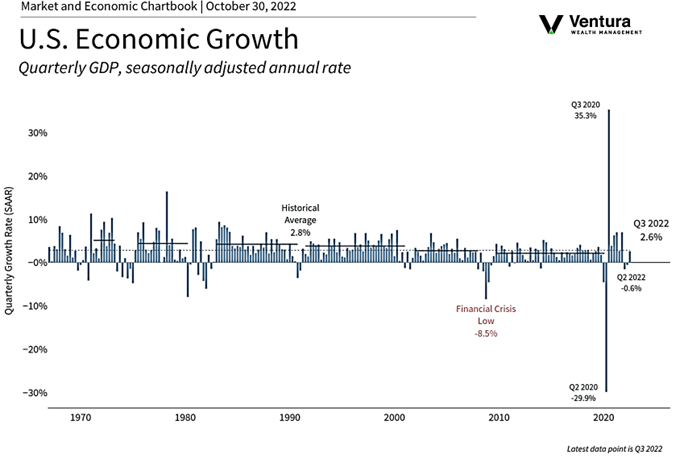

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Haver, Bureau of Economic Analysis

Statistic of the Week:

ConsolidatedCredit.org, Barron’s

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4. Investor’s Business Daily

5. Investor’s Business Daily

6.Bloomberg

7. Barron’s

8. Investor’s Business Daily

9. Barron’s