The Profit Margin October 30, 2023

Statistic of the Week

Hoping to live to 100? New research shows that genetics plays a larger role than previously thought. 25% of a person’s ability to live to 90 is deemed to be genetic, while those living to 100, genetics accounts for about 50%. And, if you happen to live to 106, that figure rises to 75%. There are 109,000 centenarians living in the U.S., up from 65,000 10-years ago. Scientists estimate that about 20% of the population has the genetic makeup to be able to live to 100.

Global Perspective

With the yen sliding against the dollar and the euro, the German economy will surpass Japan this year to become the world’s third largest economy. The IMF estimates that Germany’s GDP will hit about $4.43 trillion this year, while Japan will grow to $4.23 trillion. Despite climbing relatively to Japan, the German economy is not performing particularly well in this environment.

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: ISM Manufacturing, FOMC Rate Decision, Fed Chair Powell Press Conference

Thursday: Jobless Claims, Factory Orders

Friday: Nonfarm Payrolls, ISM Services

Commentary

Ugly performance across the major domestic equity indices is making October look a lot like September – a month we were happy to resign to the history books. Last week, the DJIA held up the best, falling 2.14%.1 The S&P 500 and the Nasdaq both sank into correction territory, dipping 2.53% and 2.62% respectively.2 In a countertrend, fixed income yields retreated on the week after having initially risen Monday. The 10-year Treasury yield fell 0.09% on the week to finish Friday at 4.84%.3 We view the relative stability in yields last week as a positive.

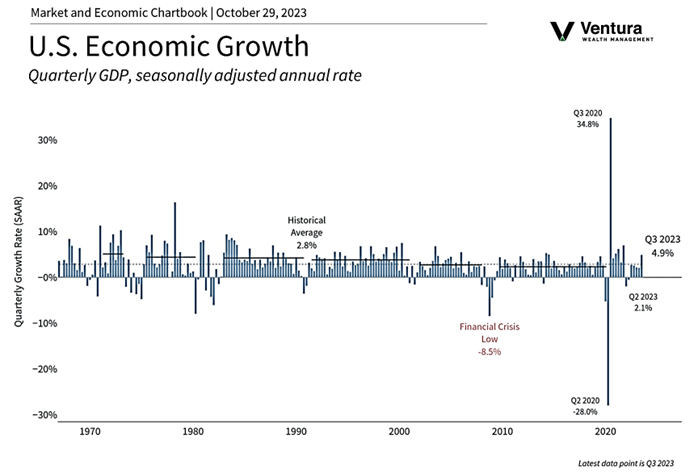

Last week we received multiple, notably strong, economic data points. Third quarter GDP (chart right) was expected to be robust; growth surpassed even those lofty expectations. Consumer spending registered growth of 0.7% in the month of September.4 Several key technology companies reported earnings last week. For the most part, they were solid. And inflation is … easing. The Fed’s “favorite” inflation gauge, the PCE, showed inflation running at a rate of 3.4% and core at 3.7%.5 The concern surrounding these data points is how the Fed interprets them, with the overarching fear that more restrictive policy is to follow.

That brings us to this week. On Wednesday we will receive the FOMC’s November rate decision. The markets are placing a near 0% probability of a hike in November and only a 20% chance of a hike in December.6 Chair Powell’s news conference to follow the announcement will be parsed. And Friday, the October nonfarm payrolls report will be released. All while earnings’ season continues. Expect volatility.

Chart of the Week

Gross domestic product grew at an annualized rate of 4.9% in the third quarter, surpassing the high end of analyst estimates of 4.7%. Consumer spending, inventory buildup, residential investment, and government spending all fueled the figure.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Economic Analysis, CNBC.com

Statistic of the Week:

The Wall Street Journal

Global Perspective: BusisinessWeek.com

Commentary:

1.Bloomberg

2.Bloomberg

3.MarketWatch.com

4. Investor’s Business Daily

5. Investor’s Business Daily

6. Barron’s