The Profit Margin: October 3, 2022

Statistic of the Week

The Employee Financial Wellness Study by Bank of America, released last week,

underscores how concerns about inflation are undercutting sentiment. The study found that

only 44% of respondents feel “financially well,” a five year low. 62% are stressed about their

finances, with 80% concerned about inflation. 71% note that the cost of living is outpacing

their salary growth.

Global Perspective

The Bank of England made emergency purchases in the bond markets last week, helping avert a potential collapse in some of the UK’s pensions. The central bank purchased $72 billion in long-term gilts (bonds) to hold off margin calls. PM Liz Truss is still pursuing ill-advised tax cuts despite elevated inflation and BOE attempts to cool the economy. The UK’s pension funds had a 2020 value of about $2 trillion.

Market Moving Events

Monday: ISM Manufacturing, Construction Spending, Vehicle Sales

Tuesday: Factory Orders

Wednesday: ISM Services

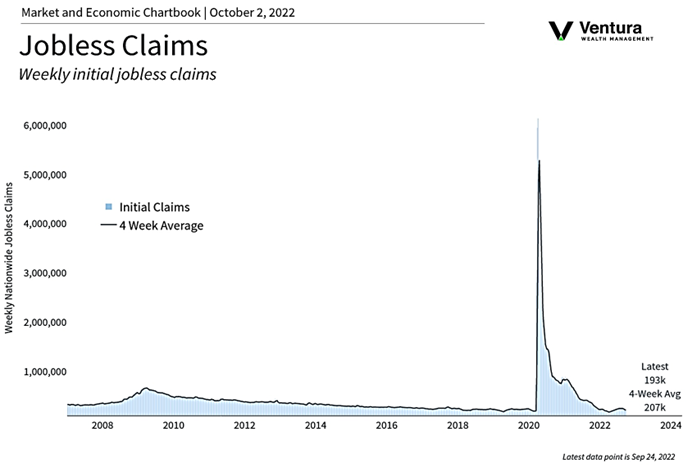

Thursday: Jobless Claims

Friday: Nonfarm Payrolls, Unemployment Rate, Consumer Credit

Commentary

Equity markets tried to rally last week, but a stronger-than-expected jobless claims report (meaning fewer people filed for unemployment than expected, chart right) soured sentiment and pushed markets lower, only to be compounded by the Fed’s favorite inflation gauge, the PCE, coming in hotter-than expected. All three averages finished the week firmly in the red. The DJIA performed the worst, dropping 2.92%.1 The S&P 500 declined 2.91%.2 The Nasdaq held up the best, retreating 2.69%.3 This weak performance capped off a tough month for equities. Fixed income investors have not faired better; yields on the 10-year Treasury have risen for nine consecutive weeks.4 The 10-year Treasury finished Friday with a yield of 3.80%, up 0.11% from the week prior.5

Historically, October tends to alleviate some of September’s poor performance. The S&P 500 has an overall average return of 0.8% in October and an average return of 2.7% during midterm election years.6 Bear markets have also bottomed in October six times since WWII.7 There is little debate that equity markets are in “very oversold” territory. As last week’s initial jobless claims pushed markets lower, this week’s nonfarm payrolls report on Friday will undoubtedly be a focal point for investors. The Federal Reserve is trying to add slack to the labor markets; so far, they have not seen significant progress. A “good” reading for investors will be a weaker-than-expected report.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Haver,

Department of Labor

Statistic of the Week:

CNBC, Bank of America

Global Perspective:

BusinessInsider.com

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4. Investor’s Business Daily

5.Bloomberg

6. Investor’s Business Daily

7. Investor’s Business Daily