The Profit Margin: October 28, 2024

Statistic of the Week

The current earnings season has seen more volatility than usual in individual stocks. The S&P 500 index has been relatively calm as it has been over a month since the index posted a daily move of greater than 1%. Historically, stocks that miss analyst expectations underperform the S&P by 2.4% in the following day’s trading. This season, those coming up short are underperforming by a margin of 3.3%. On the flip side, those beating expectations are rising more than usual, up 2.7% compared to the historical average of 1.5%.

Global Perspective

While many global equity markets remain near all-times highs, “safe haven” assets are also in demand. Gold prices set a record this week, coming close to $2,750 per troy ounce mid-week. It finished Friday with a price of $2,731.45. Year-over-year, the performance of gold has outpaced the performance of both the MSCI All-World and MSCI World Ex-U.S. indices.

Market Moving Events

Tuesday: Consumer Confidence, JOLTS

Wednesday: GDP, Pending Home Sales

Thursday: Jobless Claims, Personal Income and Spending, PCE Index

Friday: Nonfarm Payrolls, Construction Spending, ISM Manufacturing, Auto Sales

Commentary

It feels like pre-election jitters began to work their way into the investment markets last week. Thankfully, Election Day is next Tuesday. Performance in the equity indices was mixed. The Nasdaq completed a seven-week winning streak, eking out a gain of 0.16%.1 The DJIA and the S&P 500 both retreated on the week, snapping a run of six consecutive weeks with positive performance.2 The DJIA suffered the worst, dipping 2.88% while the S&P 500 fell a more modest 0.96%.3 It was arguably the move in Treasury yields that was the most notable item of the week. The 10-year Treasury finished Friday with a yield of 4.25%, up 0.16% from the week prior.4 Treasury yields have risen for six consecutive weeks, the longest streak since March ‘23.5 The volatility index (VIX) also moved up a notch. These factors, along with the movement in gold prices (see the “Global Perspective”), are hinting at a churning anxiety beneath the surface of the markets.

The week ahead is packed with major announcements. The FOMC is in a quiet period prior to their November meeting. Markets are pricing in a 0.25% rate cut. On Thursday, the PCE Deflator will be released. Analysts are expecting that the core reading (the Fed’s preferred inflation gauge) rose 0.3% for the month and 2.6% year-over-year.6 That will be followed on Friday by the BLS Employment Payrolls report. Forecasts are for a gain of 125,000 jobs.7 The hurricanes and labor disputes in September could muddy up that figure.8 And, it is a big week for earnings. Several key tech companies are reporting as are eight of the thirty components of the DJIA.9 We suspect the next two weeks will be anything but boring.

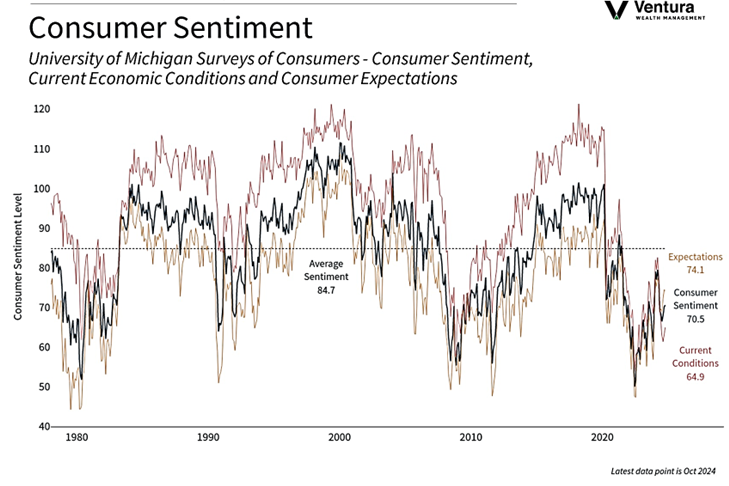

Chart of the Week

Consumer Sentiment, measured by the University of Michigan, had its highest reading since April. The first of the two October readings rose to 70.5 from 70.1. Economists are partially attributing the news to lower interest rates as some consumers consider big ticket items like homes and cars.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

University of Michigan, MarketWatch.com

Statistic of the Week:

Financial Times

Global Perspective:

The Economist

World Gold Council

Commentary:

1. MarketWatch.com, Bloomberg

2. MarketWatch.com

3. Bloomberg

4. MarketWatch.com

5. MarketWatch.com

6. MarketWatch.com

7. Investor’s Business Daily

8. Investor’s Business Daily

9. Investor’s Business Daily