The Profit Margin: October 23, 2023

Statistic of the Week

With the stock market in a lousy mood for nearly two years, many have been wondering why the U.S. economy has not slipped into a recession. Economists are pointing to the wealth of the American consumer. Since 2020, the wealth of U.S. households has risen approximately 30%, to $43.4 trillion in dollar terms.

Global Perspective

China’s GDP was reported to grow at an annualized rate of 4.9% for the third quarter – a faster growth rate than analysts had predicted. The economy experienced an uptick in both retail sales and industrial output in the month of September. Government officials have been tamping down expectations of a robust recovery due to geopolitical events and their impact on the global economy.

Market Moving Events

Tuesday: Case Shiller Home Price Index

Wednesday: New Home Sales

Thursday: Jobless Claims, GDP, Durable Goods Orders, Pending Home Sales

Friday: Personal Income and Spending, PCE, Consumer Sentiment

Commentary

Good news was bad news on Wall Street last week. A string of positive data points heightened concerns that the economy was running just a little too well. As such, the Federal Reserve may be forced to continue along the path of more restrictive interest rate policies, pushing bond yields higher. The yield on the 10-year Treasury rose 0.30% for the week, at one point breaching the 5% level before finishing Friday with a yield of 4.93%.1 When the 10-year hit the 5% yield level on Thursday, it was the first time doing so since 2007.2 Remember, the 10-year Treasury has moved from a yield of 0.52% in August of 2020.3 This rapid acceleration of yield has been one of the leading causes of pain in the equity markets. All three major averages were negative on the week. The DJIA, now negative on the year, held up the best, dipping 1.61%.4 The S&P 500 retreated 2.39%.5 The Nasdaq fell 3.16%.6

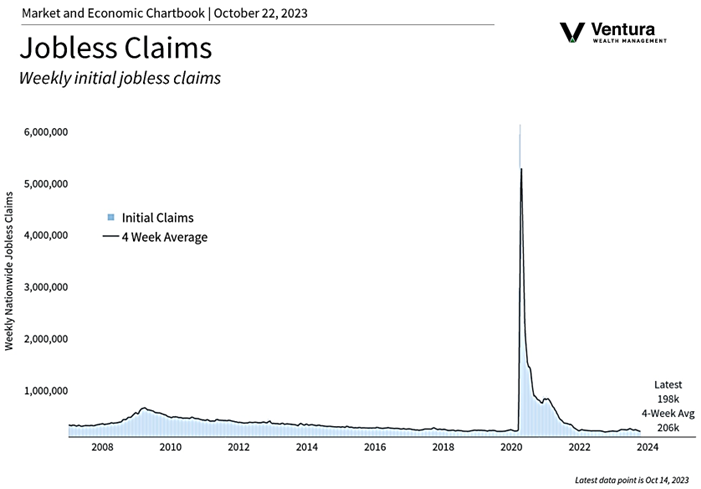

What constitutes “good news?” Initial jobless claims (chart right) have fallen below 200,000.7 The Atlanta Fed is predicting GDP growth for the third quarter of 5.4%.8 (Economists are more conservative with a forecast range of 4.00-4.25%).9 And retail sales figures, released last week, showed growth of 0.7% for the month of September, over double estimates.10 All very positive. All potentially inflationary. In the week ahead we will receive several key earnings reports, a slew of housing data, the initial GDP reading for the third quarter, and the ever-important PCE Inflation report. There is a lot on the table.

Chart of the Week

Initial Jobless Claims dipped to a nine-month low in the reading released last week. The report showed a reading of 198,000, down 13,000 from the week prior.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics

Statistic of the Week:

Barron’s

Global Perspective: The Economist

Commentary:

1.MarketWatch.com

2. Barron’s

3. Investor’s Business Daily

4.Bloomberg

5.Bloomberg

6.Bloomberg

7.Bureau of Labor Statistics

8. Barron’s

9. Investor’s Business Daily

10. CNBC.com