The Profit Margin: October 21, 2024

Statistic of the Week

401(k) accounts were established by law in 1978. They were initially designed to be supplements to private pensions. Today, only 11% of private-sector workers have pensions. This has left the 401(k) as the primary retirement savings vehicle for many. The average worker has 13 different jobs before retirement. And with each job change, comes the decision to leave, roll over, or cash out their retirement accounts. For those with balances between $1,000 and $10,000, 40% will cash out. These withdrawals can be costly. How? Talk to your wealth advisor.

Global Perspective

The European Central Bank cut their target interest rate to 3.25%. The 0.25% reduction happened as inflationary pressures continue to ease across the euro zone. The decision to cut had been expected by the markets.

Market Moving Events

Wednesday: Existing Home Sales, Beige Book

Thursday: Jobless Claims, New Home Sales

Friday: Durable Goods Orders, Consumer Sentiment

Commentary

Arguably, the biggest “October Surprise” of 2024 thus far has been the lack of an October Surprise. Markets remain buoyant. For six weeks in a row, the DJIA and S&P 500 have logged consecutive weekly gains.1 And, both the Dow and the S&P hit record levels on Friday.2 The DJIA rallied 0.96% for the week.3 The S&P 500 moved up 0.85%.4 And the Nasdaq, which did not receive any honorifics this week, still rose a respectable 0.80%.5 Gold prices crossed an important threshold. For the first time, gold hit $2,700 / ounce.6 Notably, the precious metal has rallied 32% this year, outpacing the major equity indices.7 Fixed income yields fell slightly on the week. The 10-year Treasury finished Friday with a yield of 4.08%, down 0.02% from the week prior.8

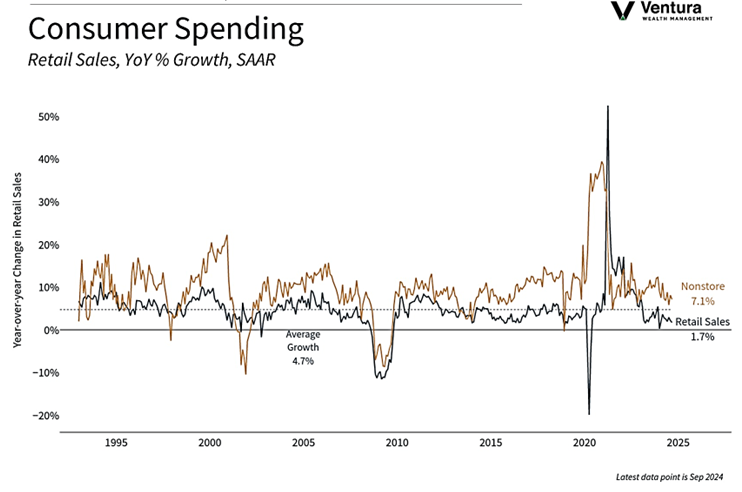

There are a lot of things going right in the U.S. economy. Retail sales (chart right) came in better than expected. While housing starts dipped slightly in September, home builders are optimistic that lower rates will draw more buyers into the market.9 (People often put off major purchase decisions in presidential election years until after the election is settled).10 The Atlanta Fed’s GDP Now indicator is forecasting that the economy grew at a 3.4% annualized rate in the third quarter, with personal spending up 3.6%.11 These are good numbers. Will they translate into more positive momentum for stocks? No one knows. Importantly, the markets look expensive. But, in 12 of the 15 times that the S&P 500 has been positive for two consecutive years, it has gone on to log a positive return in the third year, with the average return being 7.3%.12 7.3% is below average for an annual return of the S&P 500 – but it is still positive.

Chart of the Week

Retail sales grew by 0.4% in September, a faster pace than the 0.1% uptick in August. The report was above analyst forecasts. Over the past 12 months, retail sales grew at a rate of 1.7% – this figure is not inflation adjusted.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

U.S. Census Bureau,

The Wall Street Journal

Statistic of the Week:

The Wall Street Journal

Global Perspective:

The Economist

Commentary:

1. Barron’s

2. Barron’s

3. Bloomberg

4. Bloomberg

5. Bloomberg

6. Barron’s

7. Barron’s

8. MarketWatch.com

9. MarketWatch.com

10. The New York Times

11. Barron’s

12. Barron’s