The Profit Margin: October 2, 2023

Statistic of the Week

The state of Florida has overtaken New York as the nation’s second most valuable housing market. According to Zillow, California is the largest market, valued at $10.175 trillion. Florida’s market is worth $3.846 trillion, and New York real estate has a value of $3.690 trillion. Texas, followed by New Jersey, round out the top five most valuable markets.

Global Perspective

China imposed punitive tariffs on Australia during the 2020 pandemic, specifically impacting Australian wine producers. This has caused a slowdown in Australian wine exports and a glut of wine within the nation. Australia has about two billion unsold liters of Shiraz, Cabernet Sauvignon, and other varieties – enough to fill about 860 Olympic-sized swimming pools.

Market Moving Events

Monday: ISM Manufacturing, Construction Spending

Wednesday: Factory Orders, ISM Services

Thursday: Jobless Claims

Friday: Nonfarm Payrolls, Consumer Credit

Commentary

Wake me up, when September ends…” Investors will be happy to put the month of September behind them. Despite efforts at a mid-week rally, the DJIA and S&P 500 finished the week in the red ( down 1.34% and 0.74%, respectively),1 while the Nasdaq was more or less flat (up 0.06%).2 Rising yields and concerns over a now-avoided government shutdown were key drivers of investor anxiety. The yield on the 10-year Treasury rose 0.14% over the week to finish Friday at 4.58%.3 Simultaneously, crude oil was hitting highs for the year.

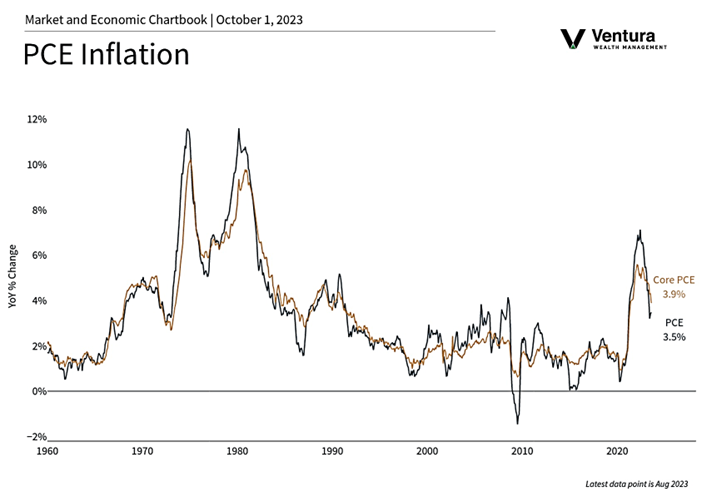

But, the news was not all bad. In fact, some was quite good. The PCE deflator (chart right) showed continued deceleration of inflation. The core reading, which excludes food and energy, fell below 4.0% for the first time since 2021.4 Over the weekend, the seemingly inevitable government shutdown was avoided by a bipartisan supported bill in the House. (Extensions beyond the 45-day continuing resolution are sure to be complicated by anger on the far right of the Republican caucus who will likely try to remove Speaker McCarthy). Additionally, personal income and personal spending both rose 0.4% in the month of August.5 The consumer still is the main engine of the American economy and has yet to meaningfully slow down.

This week’s focus will be the release of employment data for September on Friday. As the Fed is fixated on squashing inflation, a positive surprise could have negative market implications.

Chart of the Week

Growing at the slowest pace since the latter portion of 2022, core personal consumption rose only 0.1% in August. It is now annualizing at a rate of less than 4.0%. The full PCE Index is annualizing at a rate of 3.5% – this measure includes food and energy.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Economic Analysis, Bloomberg

Statistic of the Week:

Bloomberg Opinion, Zillow

Global Perspective: The Financial Times

Commentary:

1.Bloomberg

2.Bloomberg

3.Marketwatch.com

4.Bureau of Economic Analysis

5.Bloomberg