The Profit Margin: October 16, 2023

Statistic of the Week

A survey by BambooHR of more than 57,000 employees at over 1,600 companies found that the industry with the highest level of self-reported happiness is construction. The level of happiness fluctuated over the three-year period that the study evaluated, however construction worker happiness remained consistently high due to an abundance of job opportunities and rising wages.

Global Perspective

The IMF has noted that the expectation that interest rates stay “higher for longer” across the globe are impacting borrowers, specifically small and medium-sized businesses. Simultaneously, the organization is warning that the global economy could slow because of persistently high inflation. It is expected that growth in the Eurozone will only be 0.7% in 2023.

Market Moving Events

Monday: Empire State Manufacturing

Tuesday: Retail Sales, Industrial Production

Wednesday: Housing Starts, Building Permits, Beige Book

Thursday: Jobless Claims, Existing Home Sales, Leading Economic Indicators

Commentary

Domestic equity markets were mixed last week as investors grappled with hotter than expected inflation data. The gain on the Dow was 0.79% and the S&P 500 rose for the second consecutive week, up 0.45%.1 Poor action on Friday caused the Nasdaq to retreat 0.18% on the week.2 Global fears over the war between Israel and Hamas, with specific concerns about expansion and oil prices, pushed yields lower as investors sought safety. The 10-year Treasury finished the week with a yield of 4.62%, down 0.17% from the week prior.3

Earnings season picks up substantially this week. We have experienced three consecutive quarters of earnings contraction; this quarter we should see year-over-year earnings stabilize, and ultimately print positive growth in the fourth quarter.4 This is good news. The stabilization and ultimate expansion of earnings should coincide with historical seasonal strength. The market’s strongest period begins on the 197th trading day of the year (which was Friday) and has demonstrated positive returns 70% of the time since 1953 with an average gain of 6.8%.5 That is no guarantee of positive returns, but seasonality plus strengthening earnings is a powerful combination. Several Federal Reserve governors including Chair Powell are scheduled to speak this week. Their commentary, geopolitics, earnings, and the race for Speaker of the House should keep investors on their toes.

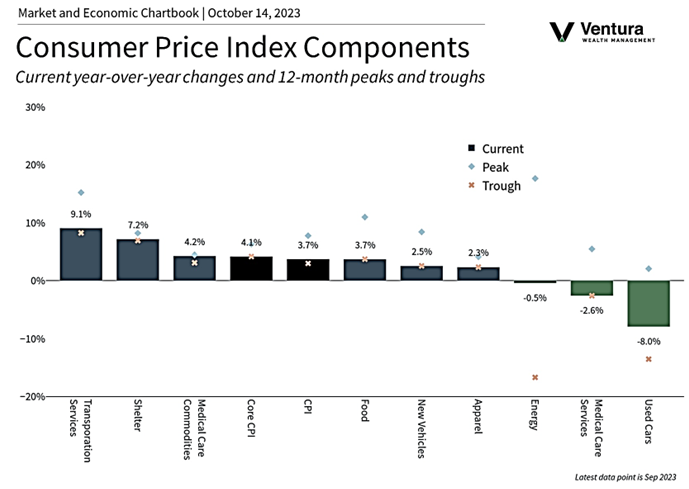

Chart of the Week

The Consumer Price Index report for September showed inflation coming in slightly above analyst expectations, rising 0.4% on the month and 3.7% year over year. Core CPI (ex food and energy) showed a year-over-year reading of 4.1%.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics

Statistic of the Week:

CNBC.com, Bamboo HR

Global Perspective: The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Marketwatch.com

4. Barron’s

5. Barron’s