The Profit Margin: October 14, 2024

Statistic of the Week

Fifty-seven percent of American workers believe that they are behind on their retirement savings, including 35% who believe that they are significantly behind. This was an uptick from last year’s survey findings by Bankrate.com. 48% who have a retirement goal do not believe they will reach it. On a positive note, 63% of workers are saving the same amount or more than they were one year ago in their retirement accounts. If you are unsure if you are on track with your retirement savings, please reach out to your VWM Wealth Manager.

Global Perspective

After jumping on stimulus expectations two weeks ago, Chinese equity markets fell notably last week when economic officials added no additional stimulus measures to what had previously been announced. The CSI 300 and Shanghai Composite both fell 7% in a day – their largest daily declines since the onset of the pandemic.

Market Moving Events

Wednesday: Import Prices

Thursday: Jobless Claims, Retail Sales, Industrial Production, Capacity Utilization

Friday: Housing Starts, Building Permits

Commentary

It was another upbeat week on Wall Street, with all three major equity indices printing positive returns. The S&P 500 and the Nasdaq have both logged gains for five consecutive weeks. And the S&P 500 and DJIA hit record highs during the week’s trading action.1 The Dow was the week’s leader, rallying 1.21%.2 The Nasdaq increased 1.13%.3 And the S&P 500 brought up the rear, climbing 1.11%.4 Inflation data that was slightly above expectations helped push bond yields higher on the week. The 10-year Treasury finished Friday with a yield of 4.11%, up 0.14% from the week prior.5 This is the highest yield that the 10-year Treasury has seen since July 31st.6

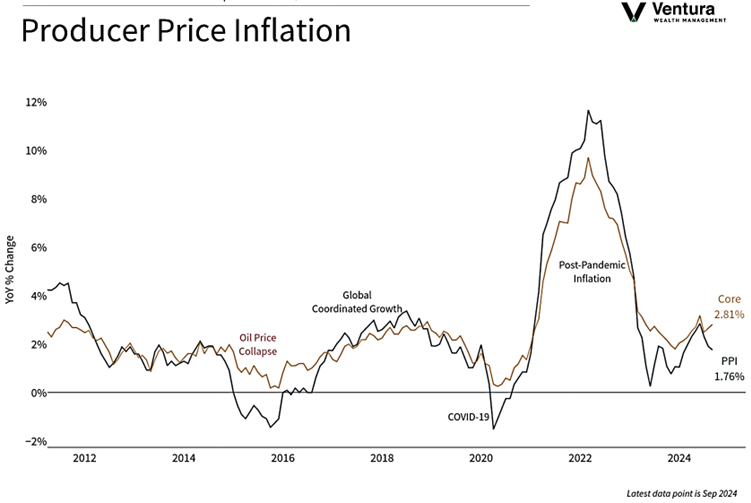

There were two major inflation reports out last week – the Consumer Price Index and the Producer Price Index (chart right). The CPI is a measure that tracks the prices of a fixed basket of consumer goods and services, while the PPI measures the average change over time in the selling prices received by domestic producers. While the PPI was flat for the month, previous monthly readings were revised higher.7 The CPI came in above expectations, with a year-over-year reading of 2.4%.8 2.3% was expected. The core-CPI also came in above expectations rising 3.3% measured year-over-year.9

Hurricanes Helene and Milton are having a significant impact on the labor market already. Initial Jobless Claims for the week ended October 5 jumped to 258,000, up 33,000 from the week prior.10 This was the highest level in over a year, with many new claims coming from Florida and North Carolina.11 270,000 claims are expected this week. Analysts believe this figure could climb to 300,000 in the weeks ahead.12

Chart of the Week

The Producer Price Index was flat in September, according to the Bureau of Labor Statistics. The 1.76% year-over-year reading was the smallest advance since February. The core reading, which removes food and energy prices, rose 0.1% during the month.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

BankRate.com

Global Perspective:

The Economist

Commentary:

1. Investor’s Business Daily

2. Bloomberg

3. Bloomberg

4. Bloomberg

5. MarketWatch.com

6. MarketWatch.com

7. Investor’s Business Daily

8. MarketWatch.com

9. MarketWatch.com

10. MarketWatch.com

11. MarketWatch.com

12. Investor’s Business Daily