The Profit Margin: October 10, 2022

Statistic of the Week

Peaking at a trading volume of $17 billion in January, transactions in NFTs have collapsed over the course of 2022. In September, trading volumes totaled $466 million. This represents a decline in transaction value of 97%. Experts believe that the total NFT market has lost about $2 trillion in value since the start of the year.

Global Perspective

OPEC and non-OPEC allies, together known as OPEC+, announced a 2 million barrel per day production cut of crude oil, prompting strong rebukes from the US and many non-oil- producing nations. Never in its history has OPEC cut production by so much in such a short period. As crude prices have fallen in recent months from $120/barrel to around $80/barrel since June, the move is designed to prop up the price as recession concerns mount.

Market Moving Events

Tuesday: NFIB Small Business Index

Wednesday: Producer Price Index, FOMC Meeting Minutes

Thursday: Jobless Claims, Consumer Price Index

Friday: Retail Sales, Import Prices, Consumer Sentiment, Business Inventories

Commentary

While domestic equity markets finished the week in the black, volatility was high and markets whipsawed throughout the week. All three major averages logged positive weekly results to start the third quarter. The DJIA led the pack, up 1.99%.1 The S&P 500 moved 1.51% higher, while the Nasdaq brought up the rear, rallying 0.73%.2 Fixed income yields moved higher on the week. The 10-year Treasury yield rose 0.08% from the week prior to finish Friday at 3.88%.3

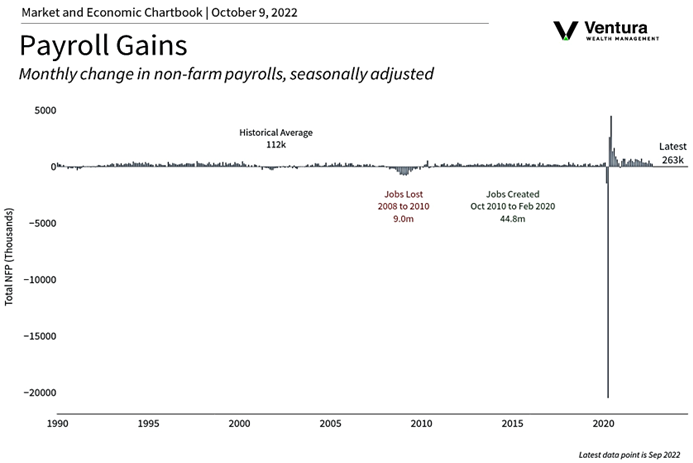

The week ahead promises to be anything but boring. There will be two key inflation reports: the PPI on Wednesday and the more closely watched CPI on Thursday. The CPI reading is expected to show a year-over-year reading of 8.1%, down from 8.3% in August.4 These inflation reports, coupled with the release of the FOMC meeting minutes, will add color to the comments given by Federal Reserve governors in the days ahead – there are a lot of them… They will also likely spend time discussing the state of the labor market. Nonfarm payrolls (chart right) came in stronger than expected5 – a “good news” item that was treated as “bad news” by investors. That contrasts with the JOLTS report which showed that the number of available job openings fell by over 1.1 million in August.6 (There are still over 10 million job vacancies, but it was the largest drop since April 2020).7 To top things off, the retail sales report and consumer sentiment reports will be announced Friday as earnings’ season commences. Sit tight.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Haver,

Bureau of Labor Statistics

Statistic of the Week:

Yahoo! Finance, ArtNews.com

Global Perspective:

Bloomberg Opinion, CNBC.com

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4. Investor’s Business Daily

5.Haver

6.Axios

7.Axios