The Profit Margin: November 7, 2022

Statistic of the Week

During the pandemic, retailers worked extra hard to make returns for online purchases easier. However, now that the pandemic is behind the economy, those returns are proving costly for companies. In 2021, about 17% of merchandise purchased online was returned, adding up to $761 billion. That figure is an increase from 11% in 2020. An increasing number of online retailers are beginning to charge restocking fees.

Global Perspective

The president of El Salvador, Nayib Bukele, linked the financial security of his country to Bitcoin and the experiment is not going well. El Salvador was the first country to declare Bitcoin a legal currency and the nation invested $100 million of its treasury funds into the cryptocurrency. The government went as far as installing Bitcoin ATMs and giving $30 of Bitcoin to each of its citizens.

Market Moving Events

Tuesday: Election Day

Wednesday: Wholesale Inventories

Thursday: Jobless Claims, CPI, Federal Budget

Friday: Consumer Sentiment

Commentary

The major domestic equity indices retreated and fixed income yields rose last week as the Federal Reserve raised interest rates yet again. The Nasdaq, with tech names most sensitive to higher interest rates, faired the worst, dipping 5.65%.1 The S&P 500 fell 3.35%,2 while the DJIA held up relatively well, retreating only 1.40%.3 The yield on the 10-year Treasury ticked up 0.15% to finish Friday at 4.16%4 – again, providing little-to-no value as a “safe haven” in 2022.

Fed Chair Powell’s post-announcement press conference soured the market’s mood in a hurry. As expected, the Federal Reserve increased interest rates 0.75%.5 It is also now highly probable that the Fed will raise rates by 0.50% in December. While it appears that the central bank will be raising rates in smaller increments moving forward, Chair Powell intimated that rates would at least hit the 5.00% threshold, and that the Fed may be “erring on the side of recession.”6 The long-awaited “pivot” has yet to be seen.

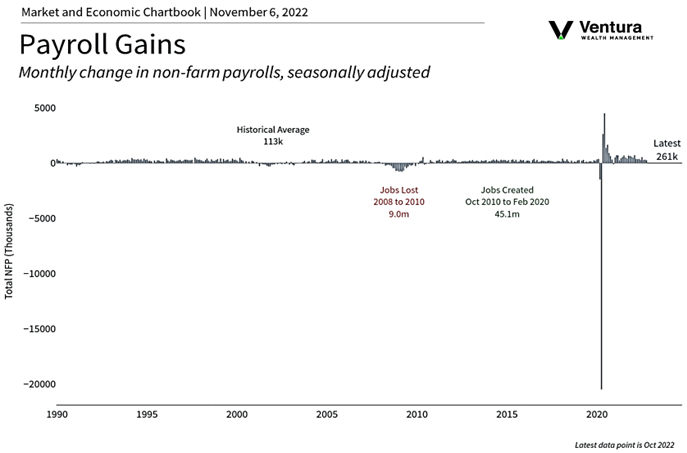

Last week’s economic data underscored the continuation of strong labor trends (chart right). And while 61% of Americans believe that we are already in a recession,7 underlying data generally point to healthy, albeit slowing, economic conditions. (“Good” trends are making it difficult for inflation to come down as fast as anyone wants). The week ahead will be dominated by election day coverage, a deluge of public commentary by Federal Reserve governors, and the ever-important CPI reading.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Haver, Bureau of Labor Statistics

Statistic of the Week:

The Wall Street Journal

Global Perspective:

Bloomberg Business

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Investor’s Business Daily

6. Investor’s Business Daily

7. Investor’s Business Daily