The Profit Margin: November 6, 2023

Statistic of the Week

Members of Generation Z are spearheading a new retirement strategy that looks very different from that of their parents. The trend, called “soft saving,” flies in the face of conventional planning where you save heavily with the idea of early or “normal” retirement. Instead, they prioritize spending on life experiences now, deferring less for the future, and plan on retiring later than their parents. 75% of the members of Gen Z would rather have a higher quality of life today than have more money in their accounts for tomorrow.

Global Perspective

In the U.S., all eyes remain focused on the resilience of the consumer as we gear up for the holiday shopping season. (Remember, consumer activity accounts for about 70% of U.S. economic activity). A recent report shows that government transfer payments as a share of personal income continue to drift lower, and they are now at the lowest levels (17.19%) since the pandemic started.

Market Moving Events

Tuesday: Trade Deficit, Consumer Credit

Wednesday: Wholesale Inventories

Thursday: Jobless Claims

Commentary

After several weeks of sustained downward pressure, dovish commentary by the Federal Reserve and softer-than-expected employment data sparked a ferocious turn-around rally. The Nasdaq was the week’s leader, putting in a gain of 6.61%.1 The S&P 500 rallied 5.85%.2 And the DJIA climbed back into positive territory on the year by rising 5.12%.3 The volatility in the equity markets was mirrored in the fixed income markets. Yields fell markedly. The 10-year Treasury finished Friday with a yield of 4.52%, down 0.32% from the week prior.4

Market participants had been impatiently waiting for a signal from the Fed indicating that the rate-hike cycle was on pause, if not finished. Chair Powell’s press conference gave many what they were looking for, stoking the rally. His comments fell into the “hint” category but were enough to spur optimism and create an environment where the Fed futures market is now showing a 0% probability of further rate hikes.5 Also on the economic data front, Nonfarm Payrolls (chart right) were weaker than expected, but the data did not fall off a cliff. This should give the Fed enough wiggle room for less-restrictive policy while the consumer should remain strong enough to maintain economic expansion. Simultaneously, earnings’ season is moving along well. Companies are not being rewarded for beating estimates (the average beat is by about 7%).6 But, we are seeing margins come in higher than expected.

Several FOMC officials are speaking this week. If there is a potential spoiler, their comments are likely to be the culprit.

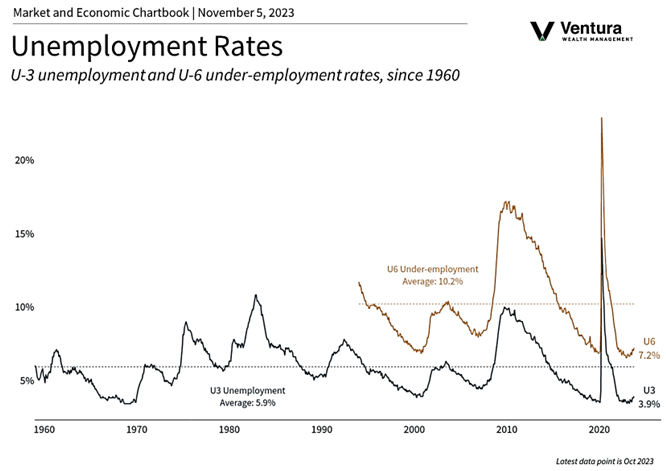

Chart of the Week

In the Nonfarm Payrolls report for the month of October, it was reported that the U.S. economy added 150,000 jobs and the unemployment rate rose to 3.9% from 3.8%. The 3.9% reading is the highest unemployment rate since January 2022.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics, Investor’s Business Daily

Statistic of the Week:

CNBC.com, Intuit

Global Perspective: Charles Schwab

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Barron’s

6. Barron’s