The Profit Margin: November 28, 2022

Statistic of the Week

Is it the naivety of youth or a signal of good things to come? In a survey by Goldman Sachs, only 45% of respondents said that they believed that their financial situation would improve in 2023. However, 77% of the members of Gen Z and 54% of the Millennials were optimistic about the future. Older age cohorts… not so much.

Global Perspective

By the end of this year, international travel will hit 65% of record, pre-pandemic levels set in 2019. The World Tourism Organization noted that 700 million people traveled to a different country through September – a year-over-year increase of 133%. European summer travel reached about 90% of pre-pandemic levels. Two notable exceptions with strong growth: Turkey and Serbia. Both are on a short list that currently welcome Russian tourists.

Market Moving Events

Tuesday: Consumer Confidence, Home Price Index

Wednesday: GDP Revision, Job Openings, Pending Home Sales, Beige Book

Thursday: Jobless Claims, PCE Price Index, Income and Spending, ISM Manufacturing

Friday: Nonfarm Payrolls, Unemployment Rate

Commentary

Stocks and bonds both rallied in last week’s shortened trading. In equities, the DJIA led the pack, climbing 1.78%.1 The S&P 500 rose 1.53%.2 And the Nasdaq, this year’s chronic under-performer, brought up the rear, closing the week out up 0.72%.3 Yields fell causing bond prices to rise. The 10-year Treasury finished Friday with a yield of 3.70%, down 0.12% from the week prior.4

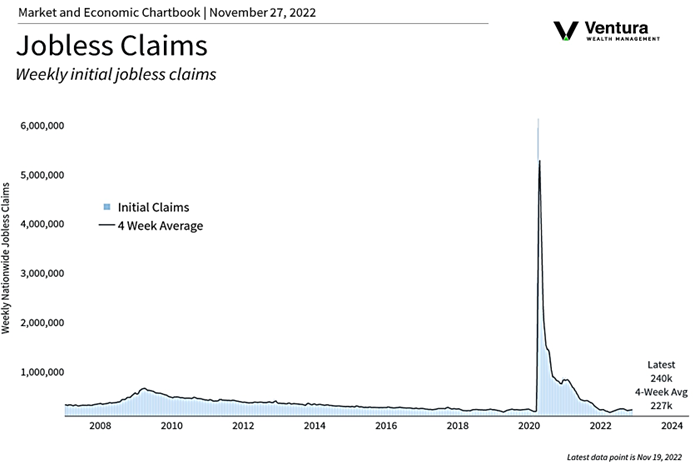

Strong earnings reports from select retail stores and comments in the minutes from the last FOMC meeting helped buoy investor sentiment. This comes at a time when the labor market appears to be weakening. Jobless claims (chart right) have been trending higher in recent weeks. On Friday, we will receive the Nonfarm Payrolls report for the month of November. There is speculation that it could be the weakest reading since December 2020 (before the vaccine rollout).5 Analysts are expecting the unemployment rate to remain firm at 3.7%.6

The other major report this week will be the PCE Price Index on Thursday. This is known as the “Fed’s favorite inflation indicator.” While we believe we are past “peak” inflation, there is ample debate as to how quickly it will recede. Expect this reading to be a market-moving event. The market has been in a good mood so far in the fourth quarter. Will the labor market and inflation reports allow that mood to continue?

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Haver, Bureau of Labor Statistics

Statistic of the Week:

Money Magazine

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Investor’s Business Daily

6.MarketWatch.com