The Profit Margin: November 27, 2023

Statistic of the Week

Thinking about managing your own money? A recent study by Vanguard might convince you otherwise. Over 25 years, a hypothetical $500,000 diversified portfolio would grow to about $1.69 million when you self-manage. However, utilizing a financial advisor, the same $500,000 grows to a projected average of $3.4 million. “Behavioral coaching,” like helping clients “stay the course” with discipline and guidance during difficult periods, can add 1-2% in net returns to portfolio performance.

Global Perspective

The Turkish Central Bank made a surprise move last week, raising interest rates by a larger than expected amount: 5%. That brings the target rate up to 40% with inflation running at 60%. This move happened while the central bank simultaneously indicated that they will end the tightening cycle soon. Target interest rates have moved from 8.5% to 40% in under six months.

Market Moving Events

Monday: New Home Sales

Tuesday: Consumer Confidence

Wednesday: GDP (revision), Beige Book

Thursday: Jobless Claims, PCE Index, Personal Income and Spending

Friday: ISM Manufacturing, Construction Spending, Auto Sales

Commentary

Equity markets traded higher in the shortened holiday week while fixed income markets were largely stable. All three major indices finished the week in the black. The DJIA, which has been the year-to-date laggard, was the week’s leader, up 1.27%.1 The S&P 500 rose an even 1.00%.2 And the Nasdaq logged a gain of 0.89%.3 Fixed income yields rose slightly on the week. The yield on the 10-year Treasury rose 0.03% to finish Friday with a yield of 4.47%.4

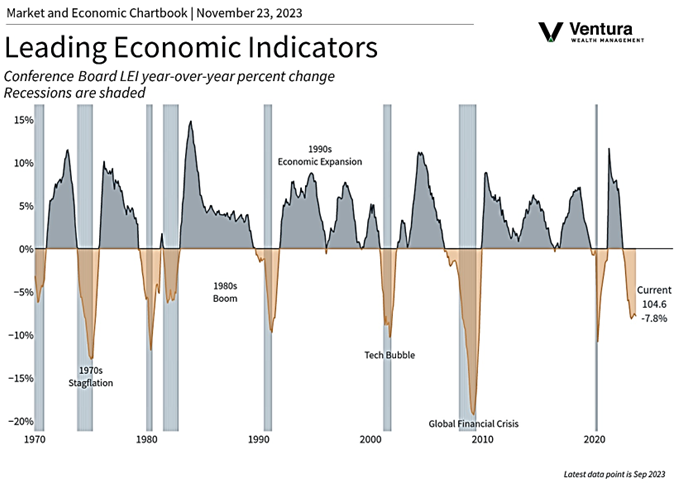

By the majority of indicators, the Federal Reserve is done raising short-term interest rates. (Importantly, they are not done shrinking the balance sheet – a factor with too many implications to cover in this weekly note). U.S. economic activity continues to look good enough. The Atlanta Fed’s forecasting mechanism, GDP Now, indicates that the economy will finish the year having risen 2.8%.5 While Leading Economic Indicators (chart right) and durable goods orders have been weak, the consumer continues to “hang in there.” (The weakness in LEI and durable goods can be accounted for in some respects to the post-pandemic righting of the economy and certain key factors like the UAW strike).

And the housing market? High interest rates and low inventories pushed October’s existing home sales to a 13-year low.6 Does that mean the consumer is throwing in the towel? Well… nearly half of U.S. homeowners took advantage of low rates during the pandemic.7 Today, about 60% of American homes have mortgages.8 Of which, 90% have mortgages 4% or lower.9 Those low rates free up a lot of buying power.

Chart of the Week

The Conference Board’s Index of Leading Economic Indicators fell for the 19th consecutive month in October, the longest losing streak since the Great Recession. The Board’s statement accompanying the release indicates that they expect a “very short recess

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

The Conference Board

Statistic of the Week:

Yahoo! Finance, Vanguard

Global Perspective: The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Barron’s

6. Investor’s Business Daily

7. Barron’s

8. Barron’s

9. Barron’s