The Profit Margin: November 25, 2024

Statistic of the Week

Once again, savers and investors are being reminded of the importance of making sure that their deposits are insured. As some fintech startups attempt to lure customers with higher-than-average yields on deposits, it is important to consider that these deposits are often uninsured by FDIC or SIPC. The recent collapse of fintech middleman Synapse left about $65 million of customer deposits in jeopardy. The most recent settlement offer to those customers was just under $12 million.

Global Perspective

Residents of the United Kingdom had an inflation shock in the month of October. In September, the annual inflation rate was 1.7%. The annualized rate jumped to 2.3% in October. A cap on energy prices was lifted, contributing to the increase. However, the core rate, which excludes both food and energy prices, also moved higher.

Market Moving Events

Tuesday: Consumer Confidence, New Home Sales, FOMC Meeting Minutes

Wednesday: Jobless Claims, Durable Goods Orders, GDP Revision, Personal Income and Spending, PCE Index, Pending Home Sales

Thursday: U.S. Markets and VWM Closed

Friday: U.S. Markets and VWM Close at 1PM EST

Commentary

Domestic equity markets resumed their march higher last week with all three major indices ending the week firmly in the black. The DJIA was the week’s best performer – it rallied 1.96%.1 The Nasdaq jumped 1.73%.2 And the most diversified of the major indices, the S&P 500, logged a respectable gain of 1.68%.3 Fixed income yields were stable over the course of the week. Treasury yields remain near five-year highs.4 The 10-year Treasury closed Friday with a yield of 4.41%, down 0.03% from the week prior.5

While the week ahead is shortened due to the Thanksgiving holiday, there are several key economic announcements and earnings reports scheduled. Speculation regarding Federal Reserve policy will likely be front and center. On Tuesday, the minutes from the November FOMC meeting will be released. This report will be followed by the PCE Index on Wednesday. Analysts are expecting that measure will show inflation rose 0.2% for the month of October and 2.3% year-over-year.6 Importantly, the core reading, excluding food and energy, is expected to have ticked up to 2.8% year-over-year from a 2.7% reading in September.7 Over the past week, traders increased the odds of the FOMC pausing their rate cutting program to 45% from 17% the week prior.8 There is little debate that inflation is proving to be stickier than policy markers would prefer. This week’s data points will be key in helping determine the Fed’s next steps.

Have a happy Thanksgiving with your families and friends.

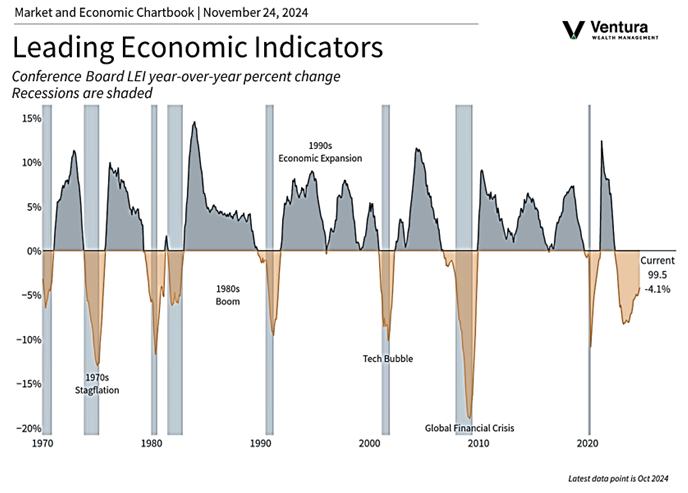

Chart of the Week

The Conference Board’s Index of Leading Economic Indicators continues to signal a dour outlook for the U.S. economy. The indicator contracted 0.3% in October and 4.1% year over year. The index has been signaling a false recession warning for years.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, The Conference Board

Statistic of the Week:

CNBC.com

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. Investor’s Business Daily

5. MarketWatch.com

6. MarketWatch.com

7. MarketWatch.com

8. Business Insider