The Profit Margin: November 21, 2022

Statistic of the Week

The World Cup in Qatar is set to be the most expensive in the tournament’s history, with spending from the Arab nation hitting approximately $300 billion over 12 years. Over that period seven new stadiums, 20,000 now hotel rooms, and 1,100 miles of new roads were built. 32 nations will participate with the championship concluding on December 18th .

Global Perspective

China announced programs to boost liquidity for its property market which has been under considerable pressure. One of the measures include extending loan deadlines for developers. Debt levels (consumer and corporate) and falling sales have pressured the sector. The government programs appear to be China’s most significant measures yet to try to reinvigorate activity.

Market Moving Events

Wednesday: Durable Goods Orders, Initial Jobless Claims, Consumer Sentiment, New Home Sales, FOMC Meeting Minutes

Thursday: US Markets Closed

Friday: US Markets Close at 1PM

Commentary

Investment markets were relatively tame last week as investors heard hawkish comments from numerous Federal Reserve officials, digested positive inflation data, and considered the implications of the FTX bankruptcy. All three major equity averages retreated but held in relatively well. The DJIA dipped slightly, down 0.01%.1 The S&P 500 fell 0.69%.2 Once again the Nasdaq was the underperformer, retreating 1.57%.3 Fixed income markets were little changed. The yield on the 10-year Treasury fell 0.01% to finish Friday at 3.82%.4

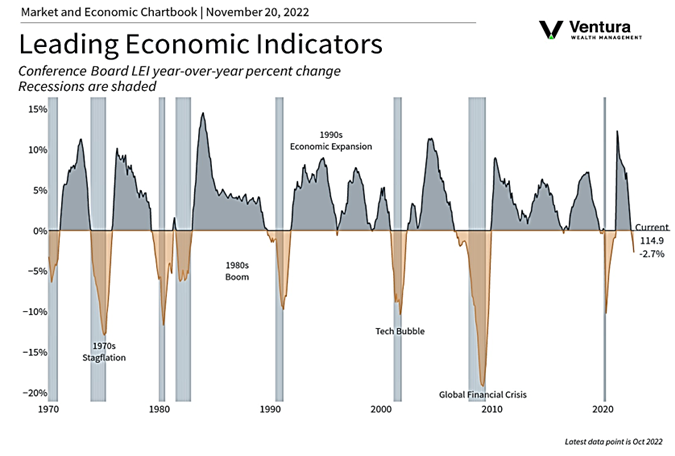

Economic data last week was mixed. Leading Economic Indicators (chart right) came in well below expectations5 causing an uptick in speculation about a recession sometime in 2023. On the other hand, retail sales beat expectations by a good margin,6 underscoring the resilience of the consumer. (These countertrends bring to mind Harry Truman’s wish for a one-armed economist). Recession fears helped contribute to a significant drop in oil prices and we continue to see inflation measures in retreat. (The Producer Price Index fell from an annualized rate of 8.4% in September to a rate of 8% in October; the core reading also dipped lower).7 The seeming lack of concern about the FTX bankruptcy appears to be showing that investors are not worried about contagion and believe that the US financial situation is in relatively good shape. This is notable. The week ahead is light on economic data except for multiple reports on Wednesday.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Haver, The Conference Board

Statistic of the Week:

Bloomberg Business

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5.The Conference Board, Haver

6. Barron’s

7. Investor’s Business Daily