The Profit Margin: November 13, 2023

Statistic of the Week

After a year of steadily climbing interest rates, home purchasers received a hint of relief last week. The average 30-year mortgage rate fell from 7.86% to 7.61%. While this might not sound like much, this move represents the most significant single-week decline in over a year.

Global Perspective

The Turkish government has made recent changes to the lineup of members on its economic team and has started the process of moving away from unorthodox economic policies. These moves allowed the country to borrow $2.5 billion on the dollar bond market, the first major deal since April. The five-year “sukuk” bond had a yield of 8.5%.

Market Moving Events

Tuesday: Consumer Price Index (CPI)

Wednesday: Producer Price Index (PPI), Retail Sales

Thursday: Jobless Claims, Import Prices, Industrial Production

Friday: Housing Starts, Building Permits

Commentary

While earnings’ season continued full ahead, last week was light on economic data releases. All three major U.S. equity averages were higher despite a slight uptick in bond yields. The DJIA was the week’s laggard, inching up 0.65%.1 The S&P 500 gained 1.31%.2 And the Nasdaq was the week’s standout performer, rallying 2.37%.3 Bond yields moved slightly higher. The 10-year Treasury finished the week with a yield of 4.65% after a less-than-stellar mid-week bond auction.4

Approximately 80% of the S&P 500 components have reported third quarter earnings with about 82% having beaten analyst estimates.5 (The average “beat rate” is around 77%).6 It appears as though earnings results are likely to accelerate through the end of the year, causing some analysts to proclaim that the “earnings recession is over.”7 Caution, however, is still warranted. While companies are beating estimates, they are not necessarily guiding forecasts higher. Estimates for 2024 earnings are almost exactly where they were before earnings season commenced.8 This is not the worst thing in the world, but it does present continued challenges for the equity markets.

Four topics are likely to dominate the week ahead: earnings, inflation, Fed speak, and the potential for a government shutdown. We will receive both the CPI and PPI inflation reports. There are numerous scheduled public comments by members of the Federal Reserve system. And importantly, Friday is the deadline to avoid a partial government shutdown. There will be plenty to digest in the days ahead.

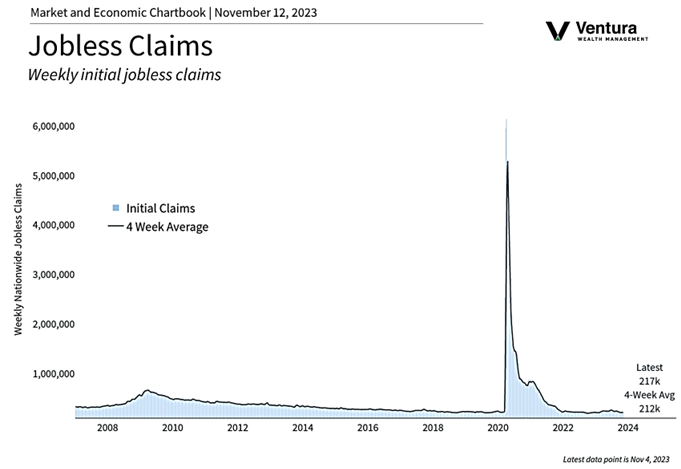

Chart of the Week

In the week ending November 4, initial jobless claims totaled 217,000. This represents a decline of 3,000 claims from the previous week’s revised level. The 4-week moving average was 212,250 claims.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

CNBC.com, Mortgage Bankers Association

Global Perspective: The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Investor’s Business Daily

6. Investor’s Business Daily

7. Barron’s

8. Barron’s