The Profit Margin: November 11, 2024

Statistic of the Week

Homebuyers in the United States are getting older. The average age of an American homeowner recently reached a record of 56, up from 49 in 2023. Home ownership costs are contributing to keeping many young Americans out of the housing market. The median selling price for a home in the U.S. is now $435,000. First-time homebuyers comprise only 24% of the buyer’s market – the lowest level for this cohort since 1981.

Global Perspective

China’s economy has been in the doldrums since the pandemic, and it is now bracing for a new round of economic tariffs when Trump’s administration kicks off. The Chinese announced a $1.4 trillion fiscal package in an attempt to shore up the economy. This includes instructing local governments to issue new bonds. The proposed new tariffs could reduce Chinese GDP by several percent.

Market Moving Events

Wednesday: CPI, Federal Budget

Thursday: Jobless Claims, PPI

Friday: Import Prices, Retail Sales, Industrial Production

Commentary

With the election finally behind us and results announced, investors made significant shifts last week. All three major U.S. equity indices put in notable gains for the week. The DJIA had its biggest daily jump in two years on Wednesday.1 The index gained 4.61% on the week.2 The S&P 500 rallied 4.66%.3 And, the tech-heavy Nasdaq soared. It logged its best week since 2022 as it gained 5.74%.4 Small cap stocks, which would arguably benefit the most from a looser regulatory environment, had their best week since 2022.5 Bond yields ultimately fell on the week, but underlying action was notably volatile. The yield on the 10-year Treasury was down 0.09% from the week prior, finishing Friday at 4.31%.6 Policies from the incoming Trump administration that could be deemed inflationary will be closely monitored by bond investors.

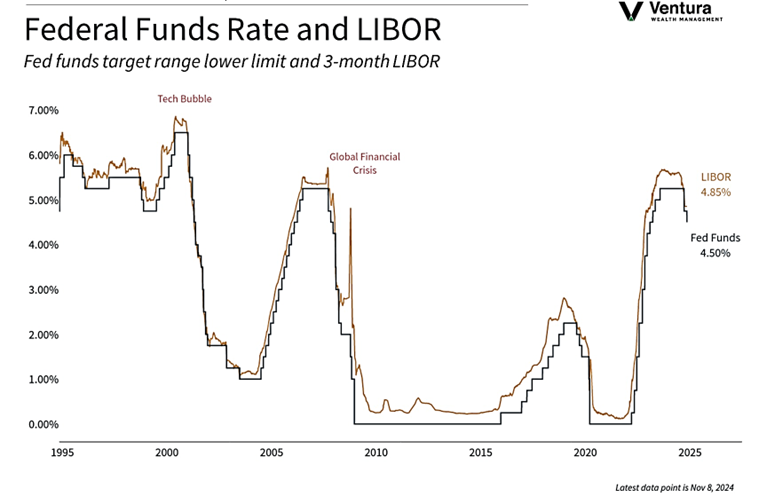

While viewed largely as a predetermined/nonevent, the FOMC meeting announcement and subsequent press conference by Chair Powell did provide some meaningful insights. Beyond cutting the target overnight lending rate (chart right), the Fed hinted that the pace of rate cuts is likely to slow in the coming months.7 This week’s CPI and PPI reports are data points that will likely be considered for the December meeting. Corporate earnings reports for the third quarter are just about wrapped up. With over 80% of S&P 500 companies having reported, analyst estimates have been surpassed by a not-too-shabby 79%.8 November and December are historically strong months for the equity markets.9 Stock investors are in a state of euphoria. When things feel too good, it is time to be worried.

Chart of the Week

The FOMC made their second rate cut of the year last week, this time cutting their benchmark interest rate by 0.25%. The range for the target rate is now 4.50% to 4.75%. This cut, along with the “jumbo” cut in September, combine for a total reduction of 0.75%.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, The Federal Reserve

Statistic of the Week:

National Association of Realtors

Global Perspective:

Financial Times

Commentary:

1. Barron’s

2. Bloomberg

3. Bloomberg

4. Investor’s Business Daily, Bloomberg

5. Investor’s Business Daily

6. MarketWatch.com

7. Investor’s Business Daily

8. Investor’s Business Daily