The Profit Margin May 8, 2023

Statistic of the Week

An increasing number of Americans are living paycheck to paycheck. In March, the number of American households feeling financially “stretched too thin” rose to 62% from 60%. Looking at age groups that are struggling, 73% of those between the ages of 27 to 42 are living paycheck to paycheck. Many are talking of scaling back expenses or taking on additional work.

Global Perspective

Political and economic risk, specifically increasing talk of socialist and leftist policies, is causing middle class and wealthy individuals in Latin America to move their money out of the region. In the region’s five largest economies, these individuals have taken $137 billion out since 2022, moving funds primarily to the US, but also to Europe and Asia.

Market Moving Events

Wednesday: Consumer Price Index

Thursday: Jobless Claims, Producer Price Index

Friday: Import Prices

Commentary

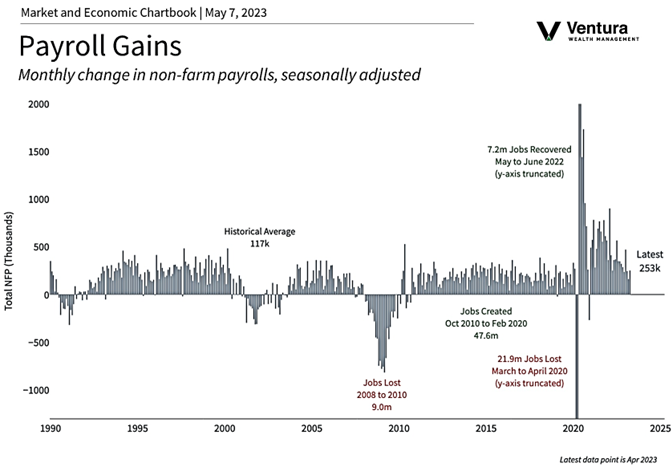

Despite a strong rally on Friday spurred by a better-than-expected jobs figure (chart right), the major domestic equity indices had a negative bias last week. Both the DJIA and S&P 500 were negative, while the Nasdaq was able to eek out a gain. The DJIA was the week’s worst performer, down -1.24%.1 The S&P 500 fell -0.80%.2 And, the Nasdaq was up 0.07%.3 While the 10-year Treasury finished the week where it started (3.45%),4 it too was volatile over the week’s trading.

Last week’s volatility was largely driven by more drama in the regional banking saga, the Federal Reserve’s rate hike, and the nonfarm payroll’s report. As expected, the Fed raised rates again by 0.25%. Some viewed Chair Powell’s remarks, especially those regarding the stability of the regional banks, as leaning towards cavalier. The nation’s central bank now has a target rate of 5.00-5.25%. The high volatility we have experienced over the past 18-months has been attributed to concerns that a recession would form as a result of Fed policy. Thus far, the jobs market is telling us otherwise. 253,000 jobs added and a 3.4% unemployment rate is impressive – irrespective of how it’s spliced.

The week ahead is light on economic data. There will be a few inflation readings (CPI and PPI) accompanied by Fed officials making public comments. However, the “big” story is likely to be a meeting between President Biden and Speaker McCarthy to start debt-ceiling negotiations.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics, Seeking Alpha

Statistic of the Week:

CNBC.com

Global Perspective:

Bloomberg Business

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg