The Profit Margin: May 6, 2024

Statistic of the Week

Fewer prime-age American men are participating in the work force. In the 1950’s, 96% of men between the ages of 24 and 54 were working full or part-time. As recently as March of this year that figure has dipped down to 86%, and now trails several other developed countries. The percentage of men participating in the workforce has been steadily declining since the 1960’s.

Global Perspective

There is a global shortage of olive oil, occasionally referred to as “liquid gold.” The staple of the Mediterranean diet has reached record-high prices, being driven by a crime surge targeting the superfood. Spain supplies approximately 40% of the world’s olive oil. The country has been trying to increase its production to meet demand.

Market Moving Events

Tuesday: Consumer Credit

Wednesday: Wholesale Inventories

Thursday: Jobless Claims

Friday: Consumer Sentiment, Federal Budget

Commentary

While the week started out on the wrong foot, Wednesday’s FOMC policy decision paved the way for higher equity prices and lower bond yields. All three domestic equity indexes gained traction last week amid several “Goldilocks” economic releases. The Nasdaq was the week’s leader, rallying 1.43%.1 The DJIA, driven by performance from a couple of key components, rose 1.14%2 And the S&P 500 brought up the rear, inching up 0.55%.3 As equity prices rose, yields fell. The yield on the 10-year Treasury dipped 0.15% on the week to finish Friday at 4.52%.4

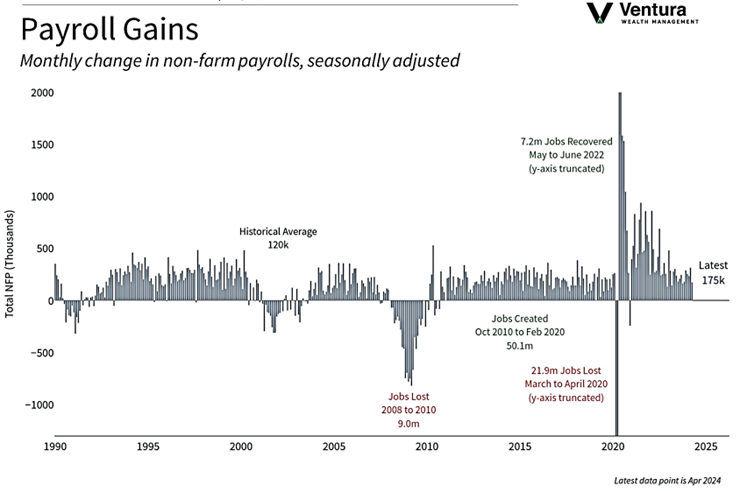

The FOMC left interest rates unchanged, matching analyst expectations. In Chair Powell’s press conference that followed the rate announcement, he allayed some investor fears by taking a rate hike off the table, saying outright, “I think it’s unlikely that the next policy rate move will be a hike.”5 The Fed also announced that it was slowing the rate at which it is shrinking its balance sheet, moving from a reduction rate of $80 billion/month to $40 billion/month.6 (This should help facilitate lower bond yields). Friday’s nonfarm payrolls report further helped bolster investor confidence and hopes that the economy still may yet come in for a “soft landing.” While still adding jobs for the month of April, the figure was softer than predicted and the unemployment rate ticked up slightly to 3.9% from 3.8%.7 Additionally, wage growth came in slower-than-expected, up 0.2% for the month and 3.9% year over year.8 In the week ahead, earnings season continues and multiple Fed governors will make public comments.

Chart of the Week

The nonfarm payrolls report for April was weaker-than-expected, with 175,000 jobs being added to the U.S. economy. Analysts had expected a figure around 240,000. The miss caused the unemployment rate to rise to 3.9%. The report for March was revised higher.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

Insider Business

Global Perspective:

CNBC.com

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Barron’s

6. Investor’s Business Daily

7.Bureau of Labor Statistics

8.Bureau of Labor Statistics