The Profit Margin: May 27, 2025

Statistic of the Week

In the first quarter, consumer debt in the United States reached an all-time high, amounting to around $18.2 trillion. Notably, there has been a decline in both auto loan and credit card debt in recent months. Conversely, student loan and mortgage debts have risen. Student loan debt is a significant factor contributing to rising delinquencies.

Global Perspective

Vacation season has arrived, prompting the Spanish government to instruct Airbnb to take down 66,000 rental listings due to growing opposition to mass tourism. This directive followed the discovery that numerous rental units were not adhering to regulations, such as disclosing whether a property is owned by an individual or a corporation. Many Spaniards argue that vacation rentals contribute to the unaffordability of local housing.

Market Moving Events

Tuesday: Durable Goods Orders, Consumer Confidence

Thursday: Jobless Claims, GDP, Pending Home Sales

Friday: Personal Income and Spending, PCE Index, Consumer Sentiment,

Commentary

Peter Lynch is known for stating, “People are concerned about the risk associated with stocks, yet bonds can be equally risky.” In 2025, volatility in the bond markets has been particularly pronounced, and last week was no exception. Following Moody’s decision to withdraw the AAA rating on American debt,1 (the last major ratings agency to do so), and the passage of the One Big Beautiful Bill Act by the House of Representatives (expected to increase the national debt by $3.1 trillion over the next decade),2 a less-than-robust 20-year bond auction occurred on Wednesday.3 These developments contributed to a rise in bond yields (indicating a drop in prices) for the week. Additionally, President Trump escalated trade tensions by threatening a 25% tariff on Apple unless the company began manufacturing iPhones domestically, along with a 50% tariff on European goods starting on June 1st if Europe did not better cooperate with U.S. trade negotiators.4 (Over the weekend, the President extended the deadline for European negotiations to July 9th).5 Consequently, equity markets reacted negatively to these announcements, with all three major indices shifting from positive to negative year-to-date performance. The DJIA and Nasdaq both declined by 2.47%, while the S&P 500 experienced its worst weekly drop since early April, falling by 2.61%.6

In this week’s shortened trading, all eyes will be focused on Nvidia’s earnings report on Wednesday and the PCE inflation report on Friday. The PCE report will be the last before the impact of the tariffs is expected to show in the data.

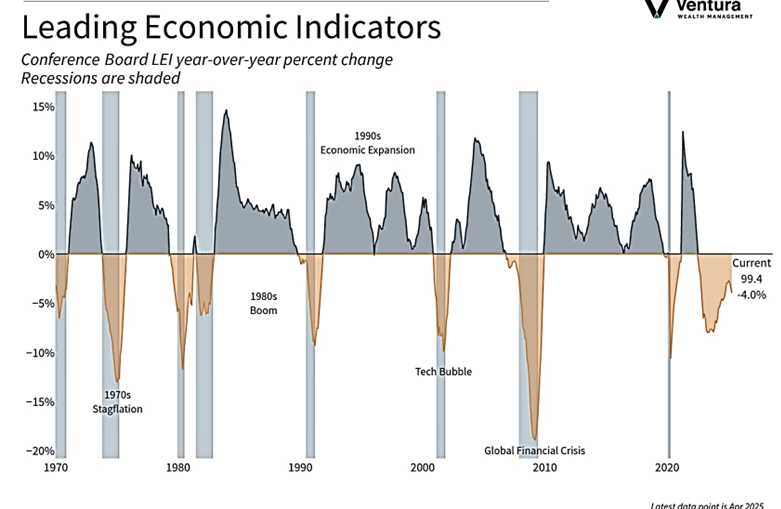

Chart of the Week

In April, the Conference Board’s Index of Leading Economic Indicators experienced a significant decline of 1.00%. This marked the largest monthly decrease in more than two years. Although the Conference Board is not issuing a recession warning, it does expect a slowdown in growth.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

The Conference Board, MarketPlace.or

Statistic of the Week:

Yahoo! Finance

Global Perspective:

The Economist

Commentary:

1. Investor’s Business Daily

2. Barron’s

3. Barron’s

4. Investor’s Business Daily

5. CNBC.com

6. Bloomberg