The Profit Margin: May 23, 2022

Statistic of the Week

Money issues are impacting the nation’s mental health. In the American Psychological Association’s most recent Stress in America Survey, 40% of American adults said that money issues were negatively impacting their mental health. 57% are concerned about insufficient savings, 56% worry about being able to afford everyday expenses, and 48% worry about their debt burden.

Global Perspective

In what is believed to be a retaliatory move against Finland for starting the application process for NATO membership, Russian natural gas shipments to the country stopped over the weekend. The move was sudden and was announced by Finland’s state-owned gas provider, Gasum.

Market Moving Events

Tuesday: New Home Sales

Wednesday: Durable Goods Orders, FOMC Meeting Minutes

Thursday: Jobless Claims, Pending Home Sales, GDP (revision)

Friday: PCE Inflation, Personal Income and Spending, Consumer Spending, Consumer Sentiment

Commentary

Markets continued their downward trajectory last week, with all three major US equity indices finishing firmly in the red. The Nasdaq was the worst performer, dropping -3.82%.1 The S&P 500 fell -3.05%.2 And the DJIA held up the best, retreating -2.90%.3 The DJIA has fallen for eight consecutive weeks in a row, performance the index has not replicated since 1932.4 Fixed income yields continued their recent trend lower. After topping out at a yield of 3.20% several weeks back, the 10-year Treasury finished Friday with a yield of 2.79%, down -0.14% from the week prior.5 Volatility in the fixed income markets has rivaled that demonstrated by the equity markets,

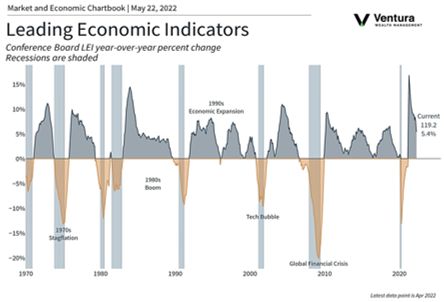

Retail sales figures were relatively strong last week,6 however poor earnings reports from two of the nation’s top retailers, Walmart and Target, caused investors to seriously consider the state of the consumer and how well companies are navigating the current environment. Leading Economic Indicators (chart right) are still healthy; however, they came in below expectations for the month of April.7 With the S&P 500 hovering close to a 20% dip below its record peak, expect the news media to have flash reports highlighting whether the S&P is in a “bear market.” At this stage, we would argue that the S&P 500 has not yet entered a bear phase as there are both time and magnitude components to the technical definition. Yet, this correction and the volatility accompanying it are severe. Caution is warranted.

Chart of the Week

Sources

Statistic of the Week:

CNBC.com, Bankrate

Global Perspective:

CNBC International

Market Moving Events:

MarketWatch.com

Chart of the Week:

Haver, Clearnomics, Conference Board

Commentary: 1.Bloomberg 2.Bloomberg 3.Bloomberg 4. Barron’s 5.Bloomberg 6. Barron’s 7.Conference Board, Haver 8.Barron’s 9.Bloomberg, Investor’s Business Daily 10.Investor’s Business Daily 11.Investor’s Business Daily