The Profit Margin: May 20, 2024

Statistic of the Week

The DJIA closed above 40,000 for the first time in its 139-year history. However, a preliminary reading of Consumer Sentiment, as measured by the University of Michigan, hit a six-month low. The indicator logged its biggest monthly decline since 2021. Investors are concerned that ongoing inflation, a creep in the unemployment rate, and slow-to-fall interest rates will worsen in the months ahead.

Global Perspective

President Biden placed a new round of tariffs on American imports of Chinese goods, specifically targeting the electric vehicle market. Even though the U.S. imports relatively few Chinese EVs, the president said that the step was pre-emptive. Semiconductors, solar cells, and critical minerals were also part of the measure. China has stated it will retaliate.

Market Moving Events

Wednesday: Existing Home Sales, FOMC Meeting Minutes

Thursday: Jobless Claims, New Home Sales

Friday: Durable Goods Orders, Consumer Sentiment

Commentary

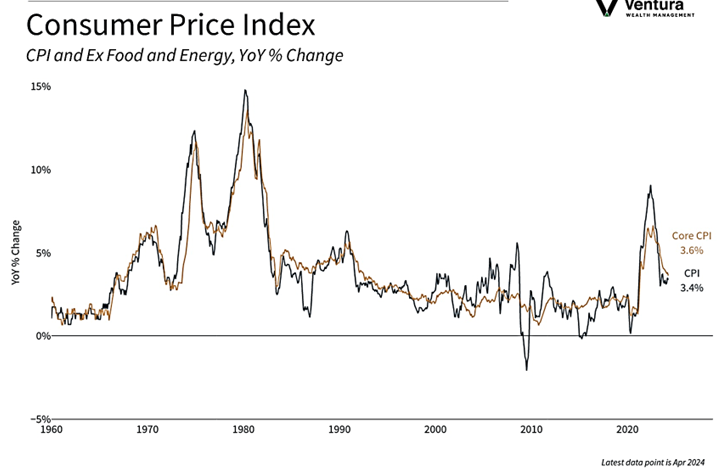

Right now, it appears “bad news is good news.” On the whole, last week’s economic data points highlighted a still strong, yet softening, U.S. economy. Retail sales, expected to be up in April, were flat.1 The Producer Price Index came in hotter-than-expected, and a preliminary reading of Consumer Sentiment (see the “Statistic of the Week) was ugly. Nevertheless, a better-than-expected Consumer Price Index reading (chart right) helped mollify concerns. After three consecutive monthly increases of 0.4%, April’s 0.3% bump was seen as bucking the trend.2

All three major averages finished the week strongly in the black. The DJIA, the week and year’s weakest performer by a notable margin, stole the spotlight, closing above 40,000 for the first time. It rallied 1.24%.3 The S&P 500 rose 1.54% and the Nasdaq jumped 2.11%.4 The Nasdaq has risen for four consecutive weeks and is virtually tied with the S&P for the slot of year-to-date leader.5 Both hit record highs during the week. Fixed income yields fell to the delight of both stock and bond investors. The 10-year Treasury finished Friday with a yield of 4.43%, down 0.07% from the week prior.6

The week ahead is very light on economic releases and very heavy on public comments from FOMC officials. Undoubtedly, they will be looking to spin the release of FOMC meeting minutes due out Wednesday. Investors will follow this release carefully. Markets are still looking for this cycle’s first rate cut sometime in the third quarter. While consumer sentiment is low, investor sentiment remains spirited.

Chart of the Week

The April Consumer Price Index reading was better-than-expected, increasing 0.3% for the month and 3.4% year over year. The year-over-year reading is also better than what the U.S. economy experienced in March, 3.5%. Core inflation was also better than expected.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

University of Michigan, The Washington Post

Global Perspective:

The Economist

Commentary:

1. Investor’s Business Daily

2. Investor’s Business Daily

3.Bloomberg

4.Bloomberg

5.Bloomberg

6.MarketWatch.com