The Profit Margin: May 15, 2023

Statistic of the Week

While authorities in Italy have not yet capped prices, the inflation rate of pasta, double the nation’s overall inflation rate, prompted a national emergency meeting. Prices of pasta boxes were up 16.5% year-over-year in April compared to an 8.8% national inflation rate. 60% of Italians eat pasta daily. Investigations are being called for as to the cause of the price spike.

Global Perspective

High energy prices are being blamed for excess mortalities in Europe for the winter of 2022-2023. While energy prices have since fallen, electricity and gas prices were up 69% and 145%, respectively, last winter, compared to prices two years prior. The unaffordability of those high heating costs may have caused up to 68,000 excess deaths – more than the fatalities attributed to covid.

Market Moving Events

Monday: Empire State Manufacturing

Tuesday: Retail Sales, Industrial Production, Business Inventories, Home Builder Confidence

Wednesday: Housing Starts, Building Permits

Thursday: Jobless Claims, Existing Home Sales, Leading Economic Indicators

Commentary

The major domestic indices were mixed last week as investors grappled with the continuation of a volatile earnings’ season, multiple inflation data points, and debt ceiling negations. The Nasdaq was the week’s positive performer; it rallied 0.40%.1 The S&P 500 was close to flat, dipping 0.29%.2 (This was the sixth consecutive week with a weekly change of less than 1.00% for the S&P).3 And the DJIA fared the worst, retreating 1.11%,4 largely as a result of disappointing earnings calls. Fixed income yields were largely unchanged on the week (especially notable because the week contained multiple inflation reports). The 10-year Treasury finished the week with a yield of 3.46%.5 Both the Consumer Price Index (CPI) and Producer Price Index (PPI) continued to show inflation receding. While it is generally agreed upon that inflation is not decelerating fast enough, it continues to move in the “right” direction – so much so that many economists are stating that they believe the Federal Reserve is done raising rates. Good. While there were initial reports that debt ceiling talks were stalled, leaks after the meeting between President Biden and Congressional leaders hint that there has been some progress towards a deal6 – even if that deal means kicking the can down the road. The week ahead will focus on the strength of the consumer, with the retail sales report on Tuesday and multiple earnings reports from key players. Those events, coupled with multiple Fed officials giving remarks, could make for a volatile week.

Chart of the Week

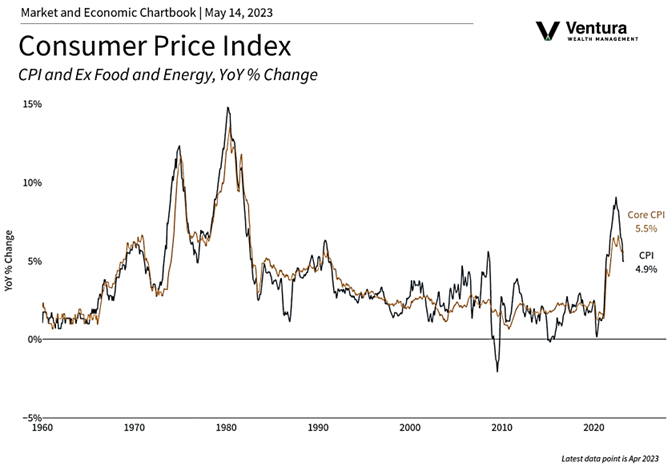

The Consumer Price Index showed the inflation rate (dark blue line) cooling to 4.9%, the slowest annual pace since May 2021. The result came in below analyst estimates and has been declining in each consecutive reading since the peak hit in June of last year.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics, Business Insider

Statistic of the Week:

Financial Times, The Washington Post

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3. Barron’s

4.Bloomberg

5.Bloomberg

6. Investor’s Business Daily