The Profit Margin: May 13, 2024

Statistic of the Week

About 84% of American adults were expected to celebrate Mother’s Day in some way, according to the National Retail Federation. The average celebration costs about $275, up about $30 from the previous year. In 2023, total Mother’s Day spending was approximately $35.7 billion, and is the third most lucrative holiday for florists (following Valentine’s Day and Christmas).

Global Perspective

Interest rate reductions are on the minds of central bankers across the world. Sweden’s central bank cut its target rate by 0.25%, the first rate cut in eight years. Recently Switzerland, Hungary, and the Czech Republic all reduced their rates. The European Central Bank is expected to cut their target rate in the June 6th meeting. The Bank of England could follow shortly thereafter.

Market Moving Events

Tuesday: Producer Price Index

Wednesday: Consumer Price Index, Retail Sales, Business Inventories

Thursday: Jobless Claims, Housing Starts, Building Permits, Industrial Production, Import Prices

Friday: Leading Economic Indicators

Commentary

All three major American stock indices posted weekly gains and are again looking to flirt with all-time highs. The DJIA was the week’s leader, rallying 2.16%.1 The Dow is on an eight-day winning streak – its longest of 2024.2 The S&P 500 rose 1.85% and is ahead of the Nasdaq on a year-to-date basis.3 The Nasdaq brought up the rear. It moved 1.14% higher on the week and has now been up for three consecutive weeks.4 Fixed income markets were relatively unchanged on the week. The 10-year Treasury finished Friday with a yield of 4.49%.5 Market participants are marking the 4.50% yield level as a “line in the sand;” momentum above 4.50% trending higher is deemed negative, while momentum below 4.50% trending lower is deemed positive.

Positive earnings data and lower interest rates have helped bolster stock prices after the April swoon. Thus far, first quarter earnings have beaten analyst estimates by a not-too-shabby 9%.6 Currently, the market is expecting the FOMC to cut rates twice between now and the end of the year.7 Recent comments by Fed officials have helped quell concerns that the central bank was positioning for an interest rate hike. The week ahead is heavy with key economic reports and corporate earnings releases in the critical retail sector. Both the Producer Price Index (PPI) and Consumer Price Index (CPI) are due out. Importantly, in last week’s consumer sentiment figure (which was a nasty miss to the downside) inflation expectations moved higher.8 The Fed does not want to see this phenomenon continue. Additionally, multiple Federal Reserve officials, including Chair Powell, will be making public comments.

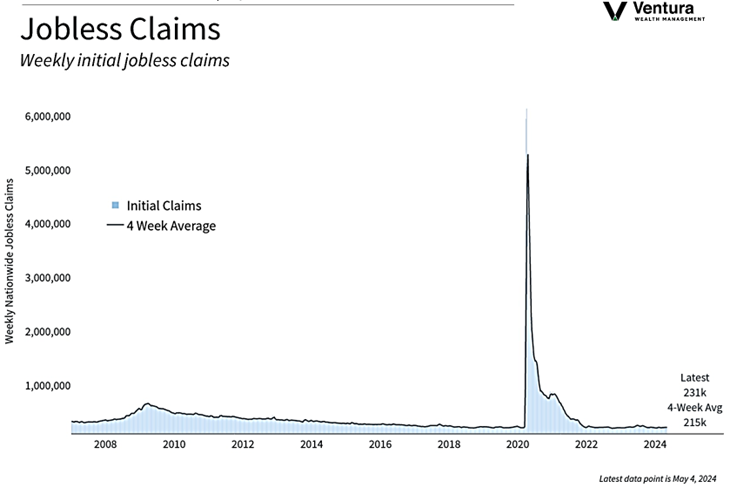

Chart of the Week

Initial jobless claims had a surprise tick higher for the week ended May 4. During that week, there were 231,000 initial filings. The four-week average sits at 215,000 – a very low reading.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

National Retail Federation, FinanceBuzz.com

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2. Barron;s

3.Bloomberg

4.Bloomberg

5.MarketWatch.com

6. Barron’s

7. Investor’s Business Daily

8. Investor’s Business Daily