The Profit Margin May 1, 2023

Statistic of the Week

While New York City still has the country’s priciest apartment rentals, Jersey City, its western neighbor across the Hudson, leads the nation’s rental rate growth. The median monthly rent for a one-bedroom Jersey City apartment was $3,000 – tied with San Francisco. This rent rate is up 28% from the prior year and represents the largest year-over-year jump of the 100 metro areas studied.

Global Perspective

Inflation rates in Europe are running notably hotter than in the United States. The UK has the dubious distinction of having Europe’s highest inflation rate. In March, the UK had a 10.1% annualized inflation rate. It was followed by Austria at 9.2%, Italy at 8.2%, and Sweden at 8.1%. Spain was on the low end, logging an annual rate of 3.1%.

Market Moving Events

Monday: ISM Manufacturing, Construction Spending

Tuesday: Factory Orders

Wednesday: ISM Services, FOMC Meeting Announcement, Fed Chair Press Conference

Thursday: Jobless Claims

Friday: Nonfarm Payrolls

Commentary

With the S&P 500 roughly halfway through earning’s season, and economic data continuing to be “good enough,” all three major domestic equity averages trended higher last week. The Nasdaq was the leader; it rallied 1.28%.1 The S&P 500 and DJIA essentially mirrored one another, rising 0.87% and 0.86%, respectively.2 In a continuing theme, fixed income yields were volatile. The Treasury yield fell 0.12% on the week to finish Friday with a yield of 3.45%.3

The current market environment is defined by three main drivers: earnings, the Fed’s battle with inflation, and the economic consequences of said battle. So far, 53% of S&P 500 companies have reported and they have been posting the best performance relative to analyst estimates since Q4 2021.4 79% have beaten earnings per share estimates.5 The bottom line is that while earnings are not great, they are not dire either. (In fact, there are notable bright spots). This gives the bulls something to cheer about to the chagrin of the bears.

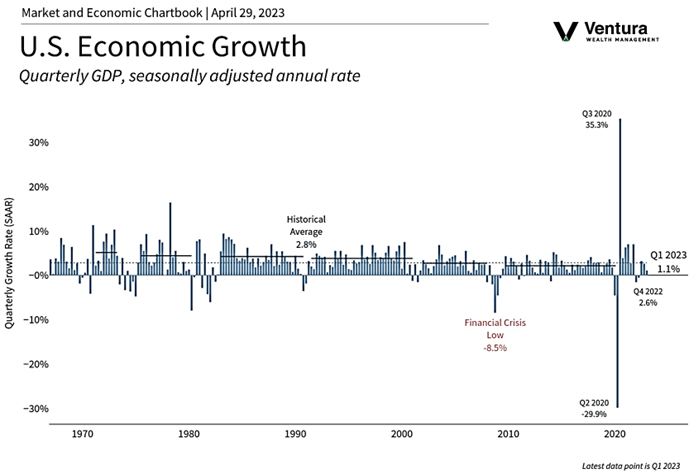

Last week, first quarter GDP was reported. Again, this data point was not great, but not terrible. We saw slower growth than analysts forecast.6 But, the economy is still growing. While corporate investment is slowing, the consumer remains stubbornly strong. This week we will have two key events: the FOMC meeting announcement and the April Nonfarm Payrolls report. Both are likely to be market-moving events.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Economic Analysis

Statistic of the Week:

BloombergBusiness

Global Perspective:

Reuter’s, Eurostat

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.FactSet

5.FactSet

6. MarketWatch.com