The Profit Margin March 6, 2023

Statistic of the Week

In his first year in office, President Biden received over $46,000 in gifts from foreign leaders. (If he wants to keep them, he must buy them back from the taxpayers through the National Archives and Records Administration). The gifts ranged in value from $433 to $12,000. Notably, the most expensive and least expensive gifts received were both pens.

Global Perspective

Stemming from China’s one-child policy, the low birthrate in China is causing its population to decline for the first time in 60 years. The city of Hangzhou is incentivizing parents by giving them $2,900 should they have a third child. Other Chinese cities are exploring incentive programs like expanding marriage leave programs.

Market Moving Events

Monday: Factory Orders

Tuesday: Consumer Credit

Wednesday: Trade Balance, JOLTS, Beige Book

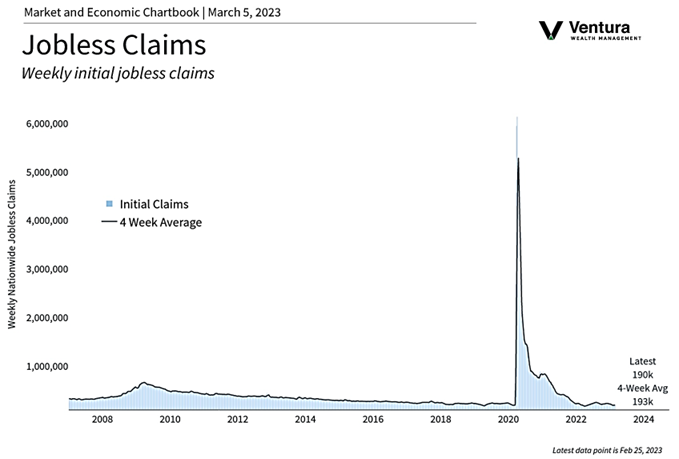

Thursday: Jobless Claims

Friday: Nonfarm Payrolls

Commentary

Last week served as a reversal week for domestic equity markets. After a string of losing weeks in February, investors began March on positive footing. All three major averages finished the week higher. Notably, they did so as the 10-year Treasury yield crossed the 4% threshold at one point during the week’s trading. The Nasdaq was the week’s leader – it rallied 2.58%.1 The S&P 500 put in a solid move higher of 1.90%, and the DJIA rose a respectable 1.75%.2 The yield on the 10-year Treasury only moved .01% higher from the previous week to close Friday at 3.96%.3 But as noted, the yield at one point had crossed above 4% and was volatile throughout the week.4

This week is busy. Fed Chair Powell will be testifying before Congress on Tuesday and Wednesday.5 We expect that he will be questioned heavily on inflation, Federal Reserve policy, the state of the economy, and the jobs market. The employment situation will also be in-focus this week as we receive February’s nonfarm payrolls report on Friday. Analysts are expecting the report to show that 215,000 jobs were added.6 This report, coupled with next week’s CPI reading, are likely to weigh heavily on the Federal Reserve’s policy announcement later in the month. While the futures market indicates that investors are anticipating a 0.25% rate hike, the odds of a 0.50% hike have been increasing, and currently stand at about 30%.7

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Bureau of Labor Statistics

Statistic of the Week:

Fortune Magazine

Global Perspective:

Business Insider

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5.MarketWatch.com

6. Barron’s

7. Inventor’s Business Daily