The Profit Margin: March 4, 2024

Statistic of the Week

While in most of the United States, average rental rates are falling, New York City is bucking the trend. New York City is the nation’s most expensive city in which to be a renter. New York City rents are up 18% year over year in the February reading, averaging $4,200/month. In Jersey City, right across the river, rents are up 5.4% year over year, averaging $3,140.

Global Perspective

There are about 10.5 million people living outside of mainland China who were born there, making the population the world’s fourth-largest diaspora. Some of these individuals are among the wealthiest Chinese. Since the pandemic, there have been indicators that the outflow of wealth is accelerating away from China, with 18% of China’s billionaires now living abroad. This has caused the state to try to increase capital controls.

Market Moving Events

Tuesday: Factory Orders, ISM Services

Wednesday: Beige Book, Fed Chair Powell before Congress

Thursday: Jobless Claims, Trade Balance, Consumer Credit

Friday: Nonfarm Payrolls

Commentary

Economic conditions continue to appear “just right” for stock market appreciation. The problem with “just right” is that a small move, positive or negative, can cause an uptick in volatility. So far, 2024 has been smooth sailing. Of the three major domestic indices, the Nasdaq was the week’s leader, rallying 1.74% and notched a record close for the first time since 2021.1 The S&P 500 rose 0.95%.2 The DJIA retreated slightly. It fell 0.11%.3 All three major averages have posted monthly gains for four consecutive months.4 Fixed income yields fell slightly on the week. The 10-year Treasury finished Friday with a yield of 4.20%, down 0.085% from the week prior.5

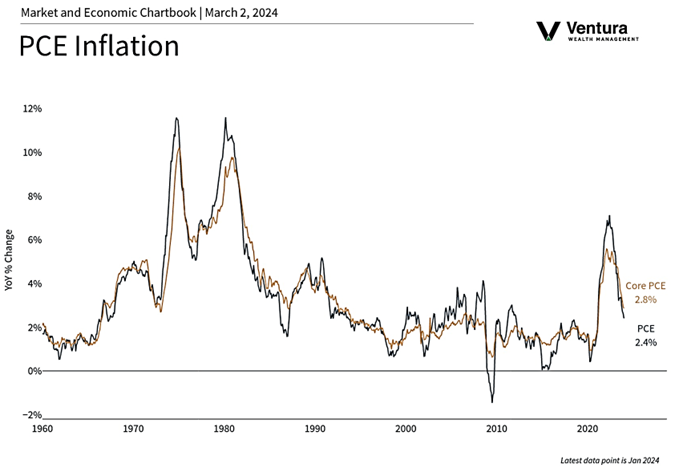

Inflation, as measured by the PCE index (chart right), was in line with analyst estimates. Looking at the past six months, core inflation (excluding food and energy) has been averaging 2.5%.6 This is a good number but is an uptick from the 1.9% rate derived from looking at the six-month period ending in December.7 Both consumer sentiment and the ISM manufacturing figures were weaker than expected.8 This week, Fed Chair Powell is scheduled to testify before Congress on Wednesday. Expect political grandstanding. Beyond that, the FOMC will convene again on March 20th. This Friday’s nonfarm payrolls figure will likely impact the Fed’s thought process on the timing of the first rate cut. Economists expect that the unemployment rate will remain the same (3.7%) in February as the economy added around 200,000 jobs. A “hot” employment report could be interpreted negatively by market participants.

Chart of the Week

The PCE Index, which is the Fed’s preferred measure of inflation, fell to its lowest year-over-year reading since March 2021 in the month of January, coming in at a rate of 2.4% and matching analyst expectations.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis, Yahoo! Finance

Statistic of the Week:

Bloomberg Wealth

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4. Barron’s

5.MarketWatch.com

6. Investor’s Business Daily

7. Investor’s Business Daily

8. Investor’s Business Daily