The Profit Margin: March 31, 2025

Statistic of the Week

It seems that Americans are not hurrying to submit their tax returns for 2024. Tax filing figures have declined across nearly all categories, with the exception ofthose anticipating a refund. So far this year, approximately 4.2% fewer returns have been submitted compared to the previous year. There is a 7% decrease in filings relative to the same timeframe in 2023. On a positive note, the average refund has risen by about 7.5% year-over-year, now standing at $3,453.

Global Perspective

The catastrophic 7.7 magnitude earthquake that struck Myanmar has resulted in over 1,600 fatalities, with many individuals still unaccounted for. Efforts for rescue, recovery, and humanitarian aid have been hindered by the ongoing civil unrest in the country. The civil war has displaced more than 3 million people. In response to the disaster, one of the resistance factions opposing the ruling military regime declared a two-week ceasefire in regions affected by the earthquake.

Market Moving Events

Tuesday: Construction Spending, ISM Manufacturing, Auto Sales, JOLTS

Wednesday: ADP Employment, Factory Orders

Thursday: Jobless Claims, Trade Deficit, ISM Services

Friday: Nonfarm Payrolls

Commentary

Domestic equity markets seesawed last week, but ultimately finished in the red. Initially, there was optimism regarding potentially softer tariff policy, which supported stock prices early in the week. However, this optimism was short-lived after the Trump administration announced a 25% tariff on foreign automobiles and parts. By the week’s end, all three major indices posted declines. The DJIA emerged as the strongest performer, decreasing by 0.96%.1 The S&P 500 dropped 1.53%, while the Nasdaq saw a decline of 2.59%.2 Meanwhile, fixed income yields remained relatively stable over the week, with the yield on the 10-year Treasury dipping by 0.02% to conclude Friday at 4.24%.3

There is much speculation surrounding a potential recession which is influencing consumer expectations. According to the University of Michigan’s consumer sentiment survey, participants anticipate an average inflation rate of 4.1% over the coming year, marking a 32-year high.4 Furthermore, 66% of respondents foresee a rise in unemployment, the most since 2009.5 We are observing “soft data” indicators, such as the survey results, suggesting negative trends. In contrast, “hard data” metrics, including job growth, retail sales, and consumer spending, continue to show strength. Several key releases, including Friday’s Nonfarm Payrolls report, will offer crucial insights. Multiple Federal Reserve officials are scheduled to speak this week, and Wednesday marks the Trump Administration’s “Liberation Day,” when reciprocal tariffs will be announced. The prevailing sentiment remains pessimistic, leading to the pressing question: Have we reached peak pessimism?

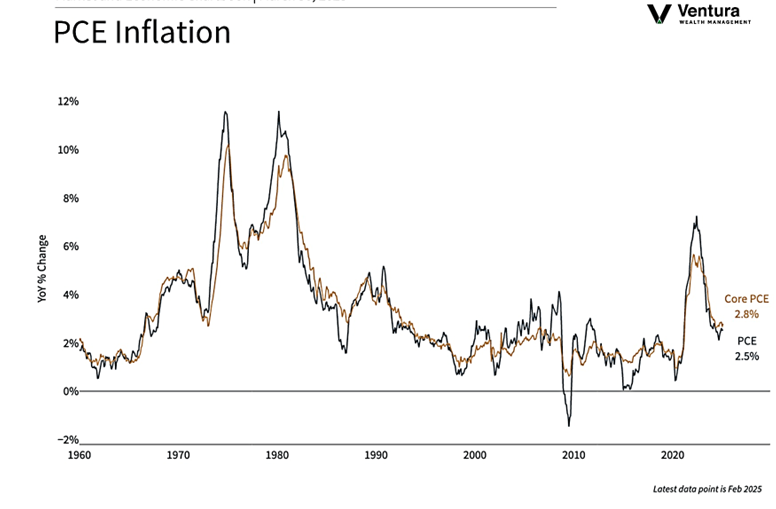

Chart of the Week

The PCE Price Index, which is the Federal Reserve’s favored measure of inflation, indicated that core inflation increased by 0.4% in February. The annual rate was noted at 2.8%, with both statistics exceeding analyst forecasts.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

Forbes

Global Perspective:

AP

Commentary:

1. Bloomberg

2. Bloomberg

3. MarketWatch.com

4. Investor’s Business Daily

5. Investor’s Business Daily