The Profit Margin: March 3, 2025

Statistic of the Week

As companies tried to get ahead of the new tariffs promised by the Trump administration, the U.S. trade deficit soared to $153.3 billion in January. Imports of industrial supplies alone jumped 33%. Updated trade figures for the month of February are due out on Thursday. We expect to see evidence of additional, accelerated purchasing in front of the tariffs scheduled to begin on March 4th.

Global Perspective

Significant corporations in the United States and China have recently revealed substantial plans for investments in artificial intelligence. Apple declared it would allocate $500 billion over the next four years, including the construction of a new factory in Houston. Meanwhile, Alibaba announced a commitment of $52 billion over the next three years for AI and cloud computing, which surpasses its total expenditure in these areas over the past decade.

Market Moving Events

Monday: Construction Spending, ISM Manufacturing, Auto Sales

Wednesday: ADP Employment, Factory Orders, ISM Services, Beige Book

Thursday: Jobless Claims, U.S. Trade Deficit

Friday: Nonfarm Payrolls, Consumer Credit

Commentary

Despite finishing Friday on a positive note, the previous week proved to be challenging for equity investors. Concerns regarding impending tariffs, a slowdown in growth, and declining consumer sentiment dominated market dynamics. While the DJIA increased by 0.95%, the S&P 500 experienced a decrease of 0.98%, and the Nasdaq faced a significant drop of 3.47%.1Nvidia’s strong performance failed to reassure investors, contributing to the Nasdaq’s decline. Overall, February turned out to be a tough month for stocks. Historically, since 1950, the S&P 500 has averaged a decline of 1.3% in February during the year following a presidential election.2As anxiety levels heightened, bond yields decreased, with the yield on the 10-year Treasury closing Friday at 4.22%, down 0.19% from the previous week.3

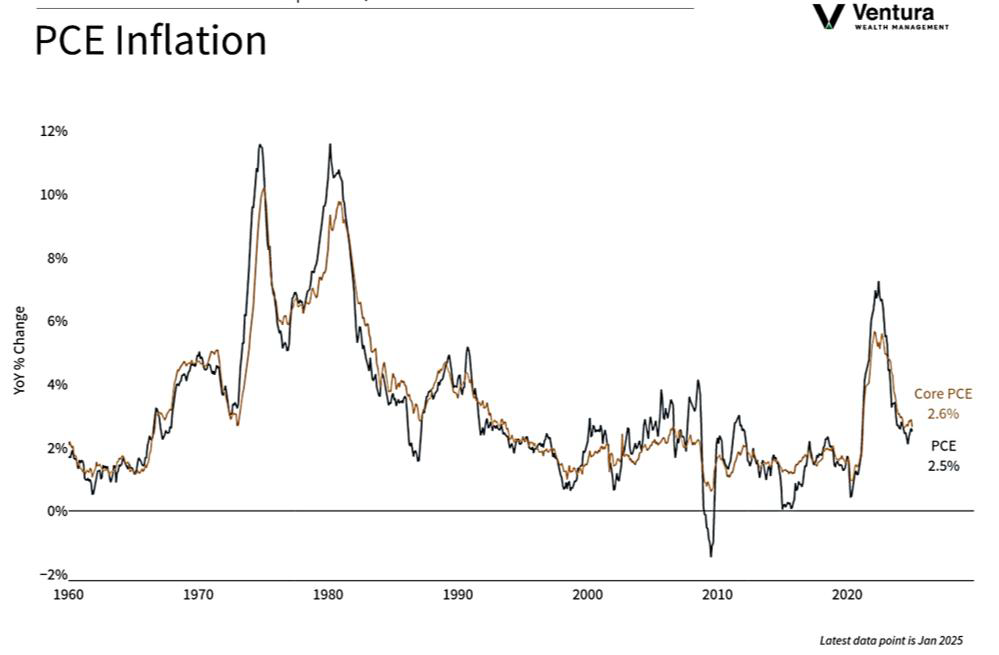

At the time of this writing, a 25% tariff on imports from Canada and Mexico is scheduled to take effect March 4th. There is broad consensus that uncertainty around trade policy, the extent of DOGE cuts, and persistent inflation (chart right) are impacting consumer confidence. The primary concern is whether these anxieties lead to a reduction in spending. Some economists suggest that we are experiencing a “soft patch” in economic growth. The Atlanta Fed’s “GDP Now” indicator recently revised its forecast for first quarter GDP growth, changing from a positive 2.3% to a negative 1.5%.4This Friday, we will see the release of the February Nonfarm Payrolls report, which is expected to show an addition of 160,000 jobs, along with an uptick in the unemployment rate to 4.1%.5Tariffs and jobs are likely to be central themes this week.

Chart of the Week

In January, the PCE price index increased at an annualized rate of 2.5%, while the core figure was recorded at 2.6%. Both results aligned with analyst forecasts. Notably, the core reading of 2.6% marked the lowest reading in seven months.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

MarketWatch.com

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. MarketWatch.com

3. MarketWatch.com

4. Barron’s

5. MarketWatch.com