The Profit Margin: March 27, 2023

Statistic of the Week

An increasing number of young people are choosing apprenticeships over higher education. In the past decade, college enrollment has declined by about 15% while the number of apprentices has increased 50%. There are an expanding number of apprenticeships now available – with about 40% now outside of construction trades. Programs are also popping up in white-collar industries like cybersecurity, banking, and consulting.

Global Perspective

A bipartisan consensus is picking up steam to increase the FDIC bank deposit insurance from $250,000 after the collapse of Silicon Valley Bank. The US has the highest bank deposit coverage in the world. Australia is second with $167,000. The European Union insures $107,000, while Canada and China both insure up to $73,000.

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: Pending Home Sales

Thursday: Jobless Claims, GDP Revision

Friday: Personal Income and Spending, PCE Index, Consumer Sentiment

Commentary

Domestic equity markets were able to log weekly gains last week despite consistent volatility. All three major averages notched positive returns. While the DJIA is in the red on a year-to-date basis, it rose 1.18%.1 The S&P 500 increased 1.39%.2 And the Nasdaq, which has been this year’s standout, rallied the most, increasing 1.66%.3 While the fixed income markets were also volatile, the yield on the 10-year Treasury finished the week more or less flat from the week prior. It closed Friday with a yield of 3.38%.4

There is still lingering stress in the banking system as consumers, investors, and officials try to sort out the failure of Silicon Valley Bank, the ongoing weakness of First Republic, and the organized sale of Credit Suisse. A recent study showed that 44.8% of lenders have recently tightened lending standards.5 Weakness in the banking system is causing lenders to be more selective. This will ultimately slow economic conditions to some extent.

The week ahead appears deceptively light on economic data. Multiple Fed governors will give public remarks. We will have better insight on the consumer as both confidence and sentiment figures will be released along with personal income and spending. Friday has the week’s “big” release: the PCE index. The PCE is the Fed’s “favorite” inflation indicator, and it will influence market expectations of future Fed action.

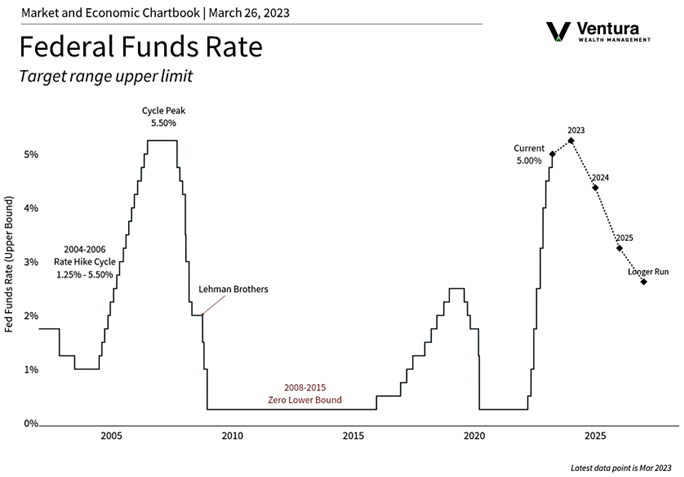

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Federal Reserve

Statistic of the Week:

The Wall Street Journal

Global Perspective:

Yahoo! Finance

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Barron’s