The Profit Margin: March 25, 2024

Statistic of the Week

There is little doubt that older Americans are spending substantial sums helping their adult children. A recent survey by savings.com of 1,000 households earning between $50,000 to $74,999 found that the average parent was spending $1,384 per month ($16,608/year) on adult children. 47% of parents were giving this aid. That figure amounts to about 27% of the average U.S. salary in 2023.

Global Perspective

Where are people the happiest? The 2024 World Happiness Report found that Scandinavians are winning in the happiness race. Finland, Denmark, Iceland, and Sweden took the top four slots. Notably, the U.S. fell out of the top 20 countries for the first time since the ranking system began in 2012 and landed at the 23rd rank. Young American adults graded their happiness levels particularly poorly.

Market Moving Events

Monday: New Home Sales

Tuesday: Durable Goods Orders, Consumer Confidence

Thursday: Jobless Claims, GDP Revision, Consumer Sentiment

Friday: Personal Income and Spending, PCE Index, U.S. Markets Closed

Commentary

Dovish comments by the FOMC and other central banks helped push U.S. equity markets higher and fixed income yields lower last week. All three major U.S. averages logged solid gains. The Nasdaq was the week’s leader, up 2.85%.1 The S&P 500 rallied 2.29%.2 And the DJIA posted its first weekly gain in March, climbing 1.97%.3 All three indices are on track for their fifth consecutive monthly gain and touched all-time highs.4 Yields fell as optimism rose. The 10-year Treasury finished Friday with a yield of 4.20%, down 0.13% from the week prior.5

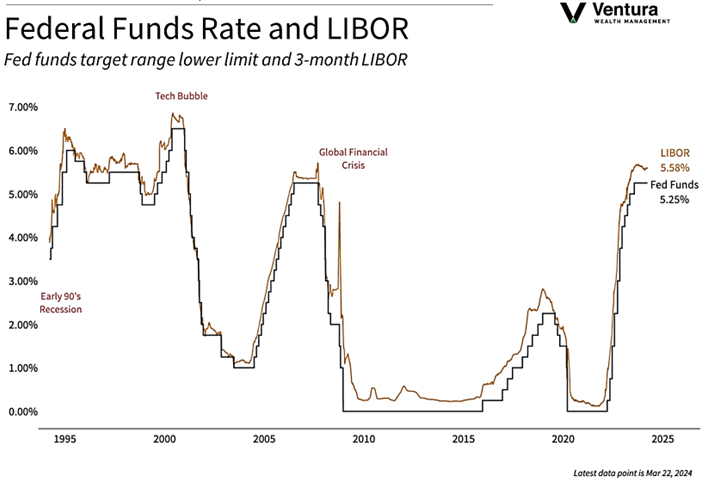

Central bank positioning has had much to do with the strength of the rally we see across multiple asset classes. While the FOMC kept their target policy rate stable last week (chart right), Chair Powell noted that the Fed would like to begin the rate cut cycle by June.6 Importantly, the futures market and FOMC projections are more-or-less in line at this point, with three rate cuts projected for 2024.7 The futures markets are placing a 75% probability of a rate cut in June.8 But, it is not just the Fed that markets are watching. The European Central Bank and the Bank of England are intimating rate cuts in the near future.9 The Swiss National Bank announced a surprise cut last week.10 The Bank of Japan finally moved their target rate into positive territory.11 And the banks of Mexico and Brazil are moving along their rate cut path.12 Coordinated central bank action appears to be moving rates lower across the globe.

The week ahead is light on economic releases. The PCE report Friday could move markets on Monday when markets reopen after Easter.

Chart of the Week

For the fifth consecutive month, the FOMC decided to maintain its current policy interest rate. Holding rates steady, the current range is between 5.25% and 5.50%. It is likely that the Fed has reached its peak rate for this tightening cycle.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

FOMC, JP Morgan Asset Management

Statistic of the Week:

Fortune Magazine

Global Perspective:

The Wall Street Journal

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4. Investor’s Business Daily

5.MarketWatch.com

6. Investor’s Business Daily

7. Investor’s Business Daily

8. Bloomberg

9. Barron’s

10. Barron’s

11. Associated Press

12. Barron’s