The Profit Margin March 20, 2023

Statistic of the Week

The collapse of Silicon Valley Bank has caused other domestic banks to borrow additional funds from the Federal Reserve. They did so through two primary mechanisms. First, they took $153 billion from the traditional “discount window,” topping the previous high of $111 billion. Second, they borrowed $11.9 billion from the new emergency loan facility – the term funding program.

Global Perspective

For the first time in over 30 years, inflation in Argentina has surpassed 100%. In February, prices rose at an annualized rate of 102.5%. Prices rose at a rate of 6.6% in the month alone, surpassing analyst estimates. In 1991, the country had an approximately 3,000% inflation rate as it was dealing with hyper-inflation.

Market Moving Events

Tuesday: Existing Home Sales

Wednesday: FOMC Meeting Announcement, Federal Reserve Chair Press Conference

Thursday: Jobless Claims, New Home Sales

Friday: Durable Goods Orders

Commentary

This loss of confidence in regional banks means there has been a sudden and significant contraction in credit availability in the economy.”1 This quote from noted commentator James Bianco encapsulates much of what markets and investors are currently experiencing. The collapse of Silicon Valley Bank and the teetering of First Republic have investors examining the foundation of the financial systems for more potential cracks. Despite volatility jumping across multiple asset classes, investors fared “ok” last week. The DJIA retreated slightly, the S&P 500 notched a gain, and the Nasdaq had its best week since mid-January.2 Notably, the yield on the 2-year Treasury fell 0.74% – the largest weekly move since the week ended October 23, 1987.3 The yield on the 10-year Treasury dipped 0.29% on the week and ended Friday at 3.40%.

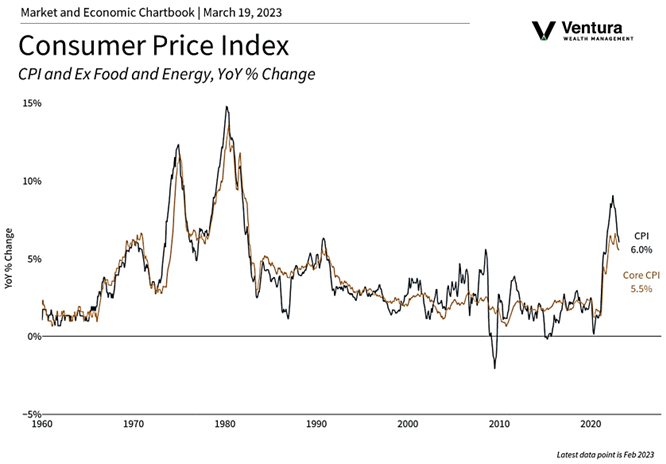

It is likely that last week’s volatility will carry forward. On Wednesday, the FOMC will have a meeting announcement. It is expected they will announce raising the target interest rate by 0.25% to 4.75-5.00%.5 Fed Chair Powell’s press conference to follow will be scrutinized for comments around credit conditions, bank conditions, future policy moves, and potential recession. We believe that the stress presenting itself in the financial system, coupled with further disinflation, makes it unlikely for there to be further rate hikes. A potential deal for the takeover of Credit Suisse and reports of Warren Buffett consulting officials on how to best manage the situation may allay some fears.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Bureau of Labor Statistics, Investor’s Business Daily

Statistic of the Week:

Insider Business

Global Perspective:

Businessweek

Commentary:

1. Barron’s

2.Bloomberg

3. Barron’s

4.Bloomberg

5. Investor’s Business Daily