The Profit Margin: March 18, 2024

Statistic of the Week

Before the pandemic, the West Coast was leading other regions of the country in job growth. Post-pandemic, the title has shifted to the Sunbelt. Pre-pandemic, the West was growing jobs at a rate of about 2.3% annually; that has downshifted to a rate of about 1.4%. Conversely, Sunbelt jobs are now growing at a rate of about 2.4%. Notably, the premium workers receive for living in certain cities (i.e.: New York) or the discount in compensation they received in rural areas, has been narrowing as remote workers spread out.

Global Perspective

Wages in Japan are expected to have risen 3.6% in 2023, the largest annual rise since 1992. Unionized workers are expecting to see their wages increase 4% this year. Wage growth is being closely monitored by the Bank of Japan, as the central bank is expected to begin the process of pulling the reigns of ultra-loose monetary policy. Negative interest rate policy could end sometime between this week and early April.

Market Moving Events

Tuesday: Housing Starts, Building Permits

Wednesday: FOMC Meeting Announcement, Fed Chair Powell Press Conference

Thursday: Jobless Claims, Leading Economic Indicators, Existing Home Sales

Commentary

Multiple data points indicating hotter-than-expected inflation contributed to weak performance for both stocks and bonds last week. All three major U.S. equity averages finished lower. The DJIA was the week’s best performer, dropping only 0.02%.1 The S&P 500 held up relatively well, dipping 0.13%.2 And the Nasdaq fared the worst, retreating 0.70%.3 Bond yields jumped considerably. The yield on the 10-year Treasury moved up 0.22% to finish the week at 4.32%.4

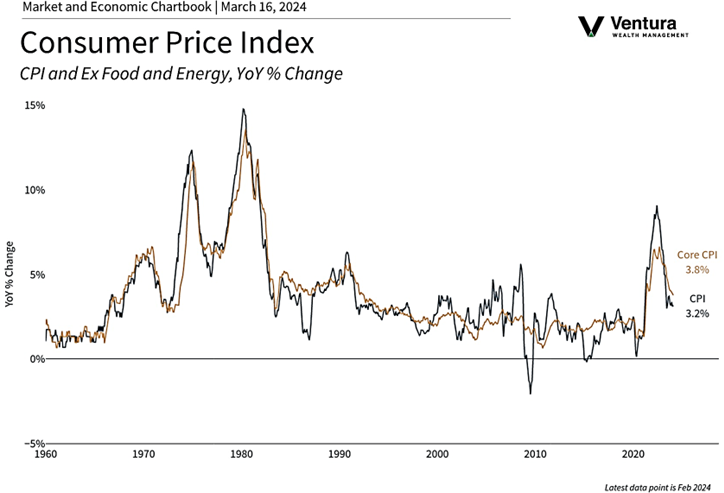

The FOMC will have a policy announcement on Wednesday. Markets are expecting no immediate change to interest rate policy.5 However, Fed Chair Powell’s press conference, immediately following the meeting announcement, will be dissected for any hints as to when the first rate cut will take place. June or July still appear to be the most likely candidates. Yet, last week’s hot CPI reading (chart right) and PPI report may prove to be spoilers. While core CPI ran at an annualized rate of 3.8% in February, when evaluating the last three months, the figure is annualizing at a rate of 4.2%.6 We believe that the “easy” decline in inflation has been captured already. The move lower into the Fed’s target range will likely be more difficult.

Beyond the FOMC meeting announcement, the Conference Board’s Index of Leading Economic Indicators will be released. This indicator has been flashing warning signs for well over a year and is once again expected to be negative. Should Chair Powell’s comments rattle the markets, and indicators look dour, it could be a volatile week.

Chart of the Week

As measured by the CPI, inflation rose slightly faster than expected in the month of February, ticking up at a year-over-year rate of 3.2%. Core CPI, which excludes food and energy, is running at an annualized rate of 3.8%. Core was at a 3.9% rate in December and January.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics, Barron’s

Statistic of the Week:

The Wall Street Journal

Global Perspective:

The Financial Times

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Investor’s Business Daily

6. Barron’s