The Profit Margin: March 11, 2024

Statistic of the Week

Combined, the “Magnificent Seven,” the seven largest capitalization weighted companies in the U.S. – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla – now produce greater profits than the combined profits produced by listed companies in each of the G20 countries, with the exception of China and Japan. The combined market cap of just these seven companies would make it the second-largest national stock exchange.

Global Perspective

China is developing the “Big Fund,” a state-backed initiative to accelerate development of cutting-edge technologies, specifically semiconductors. $27 billion is expected to work its way into the program. With the U.S. continuing its efforts to limit China’s access to semiconductors, this fund is designed to ramp up China’s internal advances. Currently, China is unable to replace technological components it receives from the rest of the world.

Market Moving Events

Tuesday: Consumer Price Index

Thursday: Jobless Claims, Retail Sales, Producer Price Index, Business Inventories

Friday: Import Prices, Industrial Production, Consumer Sentiment

Commentary

Domestic equities faltered last week but did so in orderly fashion after briefly touching record highs. All three major indices finished the week in the red. The Nasdaq, which is the leader on a year-to-date basis, retreated the most, dropping 1.77%.1 The DJIA fell 0.93%.2 And the most diversified of the major averages, the S&P 500, held up the best, retreating only 0.26%.3 Yields fell on the week, causing an uptick in bond prices. The 10-year Treasury finished Friday with a yield of 4.08%, down 0.11% from the week prior.4

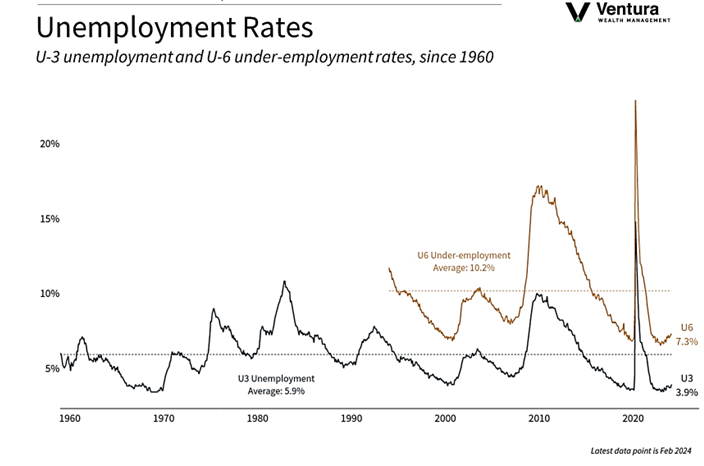

Inflation, labor markets, and the relationship between them remain key focal points for investors. In last week’s nonfarm payrolls report, we learned that the unemployment rate (chart right) had a slight move higher in the month of February.5 275,000 people found jobs during the month, a higher figure than analysts had expected.6 150,000 entered the workforce.7 The rate of change in hourly earnings slowed notably during the month, rising only 0.1%.8 Overall, we believe that the labor market remains healthy, but is demonstrating some cooling. This should help ease inflationary pressures and ultimately make life easier on the Federal Reserve.

The FOMC is slated to meet on March 19-20. The market is not expecting these meetings to result in a rate cut. It is, however, factoring in the initial rate cut at the June 12 meeting.9 This week’s CPI and PPI releases will likely factor into the decision-making process. Equities still look extended in the short term.

Chart of the Week

In Friday’s nonfarm payrolls report, the unemployment rate rose from 3.7% to 3.9%. This was the first tick higher in four months.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

CNBC.com, Deutsche Bank

Global Perspective:

The New York Times

The New York Times

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5.Bureau of Labor Statistics

6. Barron’s

7. Barron’s

8. Barron’s

9. Investor’s Business Daily