The Profit Margin: June 6, 2022

Statistic of the Week

While home affordability remains a challenge for many Americans, home ownership remains a central theme in the American Dream. A recent survey found that 74% of Americans believe that owning a home is a higher measure of achievement than earning a college degree, raising a family, or having a successful career.

Global Perspective

The Indian economy grew at an annualized rate of 4.1% for the first quarter of 2022. The pace was slower than recent readings. In April, the Indian inflation rate hit a year-over-year rate of 7.8%; notably, food prices, which account for half of the Indian consumer price index, rose at a rate of 8.4%.

Market Moving Events

Tuesday: Consumer Credit

Thursday: Jobless Claims

Friday: Consumer Price Index, Consumer Sentiment, Federal Budget

Commentary

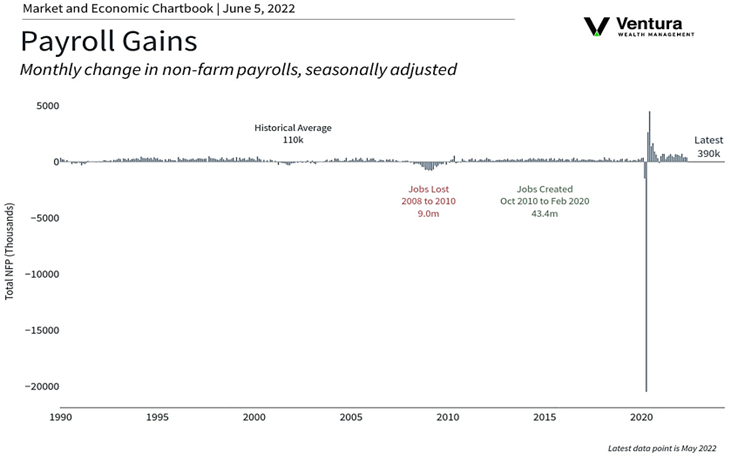

Sentiment quickly flipped back to negative last week as the markets digested Friday’s non-farm payrolls figure (chart right) and some less-than-desirable commentary from two notable CEO’s. All three major equity averages retreated. The DJIA was the week’s best performer, dropping -0.94%.1 The Nasdaq dipped -0.98%.2 And the S&P 500 fell -1.20%.3 Fixed income positions also reversed trend as yields turned higher. The 10-year Treasury yield rose 0.21% to finish Friday with a yield of 2.96%.4 Volatility was remarkably tame.

To be clear, in “normal” circumstances, the non-farm payrolls report for May would have been met with shouts of joy. 4.5% annualized job growth, a growing labor force participation rate, and steady unemployment rate5 are usually celebrated by investors. Not, however, when those investors are concerned the Federal reserve will act faster to cool the economy. That report, coupled with bearish comments from highly-followed CEOs Jamie Dimon from JPMorgan Chase and Elon Musk from Tesla, led equity prices lower for the eighth time in nine weeks..6

This week is relatively light on economic releases. All eyes will be focused on Friday’s consumer price index report. Another “hot” reading could mean July’s Fed rate hike looks more like 0.75% instead of 0.50%, something investors won’t likely celebrate.

Chart of the Week

Sources

Statistic of the Week:

The New York Times

Global Perspective:

The Economist

Market Moving Events:

MarketWatch.com

Chart of the Week:

Haver, Clearnomics, Bureau of Labor Statistics

Commentary: 1.Bloomberg 2.Bloomberg 3.Bloomberg 4.Bloomberg 5.Bureau of Labor Statistics, Haver 6. Investor’s Business Daily