The Profit Margin: June 5, 2023

Statistic of the Week

Now that the debt ceiling deal is in place, student-loan borrowers must resume making payments in three months. The deal ends the three-year freeze on payments, interest, and collections. For those that have not been making payments, now is a good time to find your loans, begin budgeting for payments to resume, and examine the full range of payment options.

Global Perspective

Slow growth in China is causing a decline in exports across the region. In April, Hong Kong’s exports to mainland China were down 13% year over year. Exports from South Korea also declined. In May, they were down by about 15%.

Market Moving Events

Monday: ISM Services Index, Factory Orders

Wednesday: Trade Deficit, Consumer Credit

Thursday: Jobless Claims, Wholesale Inventories

Commentary

With the resolution of the debate around the debt ceiling, goldilocks jobs figures, and abounding excitement around artificial intelligence, U.S. stocks put in solid gains last week. All three major domestic equity averages finished in the black. The Nasdaq was once again the weekly leader, rallying 2.04%.1 It is up to a 13-month high.2 The DJIA was able to move out of the red on a year-to-date basis with a weekly move of 2.02%.3 And with broad participation, the S&P 500 notched a gain of 1.83%.4 Yields fell on the week. The 10-year Treasury finished Friday with a yield of 3.69%, down 0.13% from the week prior.5

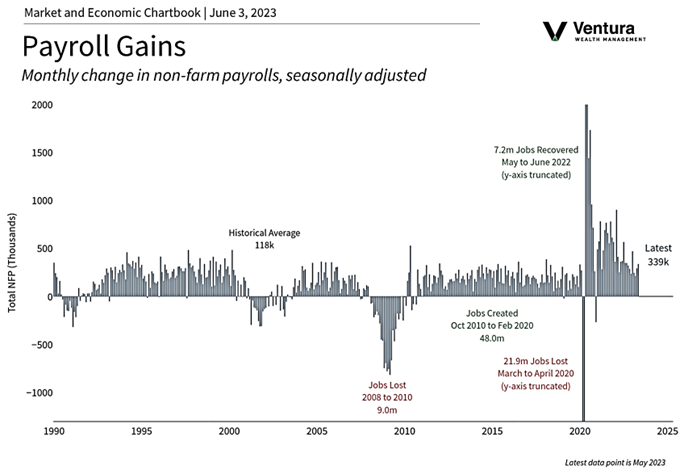

Last week’s employment figures had something for everyone. Nonfarm payrolls (chart right) surged past analyst estimates with close to 340,000 jobs added.6 Simultaneously, hours worked per week dipped 0.1%, the unemployment rate rose to 3.7% (a seven-month high), and wage growth eased to a rate of 4.3%.7 Combined, they depict a softening, but not collapsing, labor market. As a result, the odds of a rate hike this month from the Federal Reserve fell.8 The week ahead is light on economic data. Monday’s ISM Services Index release will be watched to better determine how that critical portion of the economy is performing. The manufacturing side of the economy is clearly in contraction. Services play a larger role in the overall U.S. economy than manufacturing – the quality of the figure should provide insight into the strength of the consumer.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statics, Reuter’s

Statistic of the Week:

MarketWatch.com

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg, Investor’s Business Daily

3.Bloomberg

4.Bloomberg

5.Bloomberg

6.Bureau of Labor Statics, Reuter’s

7. Investor’s Business Daily

8. Investor’s Business Daily