The Profit Margin: June 3, 2024

Statistic of the Week

The United States maintains the world’s largest defense spending budget – this year totaling about $900 billion. The amount the country spends on defense is about to be eclipsed by what it spends on debt service. Two years ago, debt service was the nation’s seventh largest expenditure. In 2024, it will become its largest. For the first seven months of 2024 (remember, the country follows a September fiscal year) net interest payments were $514 billion, $20 billion more than defense spending.

Global Perspective

Even though it has suffered heavy losses in Ukraine, the Russian army is approximately 15% larger than it was before the invasion. The Kremlin has been able to entice some recruits by raising wages to record levels. The pool of convicts, promised amnesty upon completion of their tours of duty, has been drying up. Police are now offering criminal suspects the chance to clear their charges by joining the army, before their trials.

Market Moving Events

Monday: Construction Spending, ISM Manufacturing

Tuesday: Factory Orders, Job Openings

Wednesday: ISM Services, Productivity, Trade Deficit

Thursday: Jobless Claims

Friday: Consumer Credit, Nonfarm Payrolls, Wholesale Inventories

Commentary

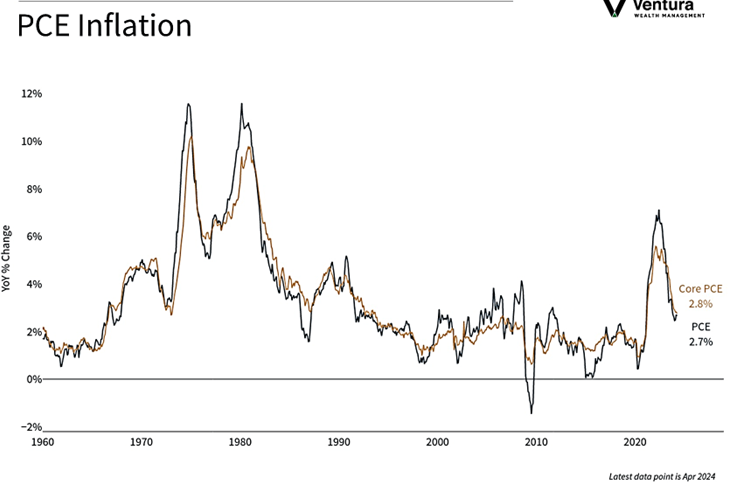

Volatility is slowly creeping up in the markets. The question is whether this is the start of “summer doldrums” or something more meaningful. Domestic equity markets finished Friday on a positive note, spurred on by an on-target inflation reading (chart right), but were ultimately negative on the week. The Nasdaq fared the worst, dropping 1.10%.1 The DJIA retreated 0.98%.2 And the most diversified of the major indices, the S&P 500, held up the best, dipping 0.51%.3 Yields jumped early in the week but pulled back in by week’s end. The 10-year Treasury finished Friday with a yield of 4.50%, up 0.03% from the week prior.4

The inflation picture is gradually improving, but not as quickly as anyone, specifically the Federal Reserve, would like. The FOMC’s next scheduled meeting is for June 12. Last week’s PCE reading will likely be discussed, as will this Friday’s Nonfarm Payrolls report. The economy is expected to have added 178,000 jobs in May and the unemployment rate should hold steady at 3.9%.5 Wages are forecast to tick up slightly to an annualized rate of 4.0%.6 If these estimates play out, it indicates that the consumer should remain in pretty good shape.

There are, however, some cracks forming. While economic growth is still positive, it is slowing. First quarter GDP growth was revised lower from 1.6% to 1.3%.7 The Atlanta Fed’s GDP Now indicator forecasts that the economy will grow at a rate of 2.7% in the second quarter – a solid reading but notably less than its previous forecast of 3.5%.8 So far, this is good enough for now, but warrants watching.

Chart of the Week

The PCE inflation reading ticked up 0.3% in April, in-line with analyst estimates and showed an annualized reading of 2.7%. Core PCE, the reading on which the Federal Reserve most focuses, also matched expectations, inching up 0.2% in the month for a year-over-year result of 2.8%.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

Yahoo! Finance

Global Perspective:

The Financial Times

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5.MarketWatch.com

6. Investor’s Business Daily

7. Investor’s Business Daily

8. Federal Reserve Bank of Atlanta